NEWS AND

EVENTS

Keeping you up-to-date with our latest happenings

Sanlam secures third High Growth Portfolio Performance win at the 2020 PAM Awards

Sanlam UK, part of the international financial services group Sanlam Ltd, last night scooped the High Growth Portfolio Performance award for its Sanlam Global Equity capability at the annual Private Asset Management (PAM) awards.

Read MoreEconomies playing catch up

For those of you who’ve spent the last few months of lockdown wishing you had a second house by the sea, now is the time to go out and buy it! UK Chancellor Rishi Sunak has announced a series of Coronavirus recovery measures including job retention bonuses for employers, a £2bn scheme to create jobs for young people and a temporary change to stamp duty. These measures may alleviate short-term pressures but are unlikely to change the longer term dynamics of the economic recovery.

Read MoreCoronavirus special: counting the cost and looking ahead

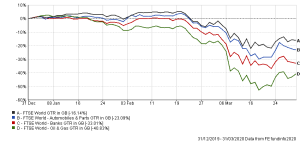

As far as equity markets are concerned, the development of the coronavirus crisis has been as rapid as it has been unprecedented.

Read MoreA cacophony of noise

We remain in a relative news vacuum, but reporting season is slowly getting underway, starting with US banks this week. These companies reported making loan loss provisions (money set aside as an allowance for potentially unpaid debts) but were held up by increased trading revenue due to activity in the fixed income market as investors snapped up bargains.

Read MoreSanlam’s Fourie: Why I’m happy to underperform when the market recovers

There is a strong chance that beaten-up sectors such as energy and financials will lead the eventual recovery from the coronavirus crash, according to Sanlam’s Pieter Fourie – but the manager said this is not enough to convince him to buy into these areas of the market.

Read MorePushed towards Risk

Earlier this week European leaders crossed the Rubicon and agreed an unprecedented economic programme. The EU have agreed a deal on a €750bn recovery fund to address Covid-19 damage; importantly, all raised by issuing EU common bonds for the first time. The issuance of these bonds will enhance the trading bloc’s financial autonomy from the US, furthering its potential role as a reserve currency.

Read MoreCOMMENTARY

We bring you current commentaries to unpack areas of interest in the financial sector

Sanlam Multi Strategy Fund and Sanlam Real Assets Fund update (October 2019)