NEWS AND

EVENTS

BITCOIN: CUTTING THROUGH THE HYPE

For the past few years, bitcoin – the original cryptocurrency launched in 2009 – has been on a roller-coaster ride of note. After dipping below US$5 000 in March last year, bitcoin peaked at over US$46 000 a few days ago following a tweet by Elon Musk that his car firm Tesla had bought around US$1.5 billion worth of the digital currency. Its current market capitalisation is around US$840 billion. For many investors, what exactly bitcoin is and how it works remain an enigma – here’s what you need to know.

Read More2021: A new cycle of economic growth and renaissance

A new year dawns with a heightened need for a fresh start. With 2020 now firmly behind us, we can approach this year with renewed hope and a desire to seek new and exciting opportunities. Caution will need to be exercised, but there is much to feel positive about.

Read MoreWill we soon be a cashless society?

Have you ever wondered what it would be like to never use cash again? No more ATMs on our high streets, no loose change languishing down the back of the sofa, and no pennies under the pillow when the tooth fairy comes to visit. It may sound farfetched, but this could become a reality sooner than we think.

Read MoreBond yields rise as economy poised to reopen

Rising government bond yields have dominated market noise this week with the yield on 10-year US Treasuries (US Government bonds) rising to its highest level in over a year. Equity indices wobbled in

response to these dynamics with fears that rising borrowing costs could derail the already fragile economic recovery.

The promise of a vaccine sees value stocks turn a corner

When equity markets rallied 8 percent on the announcement of BioNtech and Pfizer’s Covid-19 vaccine, it showed just how eager investors were for some light at the end of the tunnel. But as global lockdowns persist, it’s clear we’re not out of the woods yet, and markets pulled back again to reflect that.

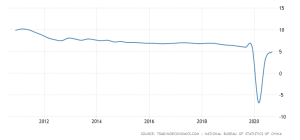

Read MoreThe magnificent Chinese recovery

The irony will not be lost on many. If China’s recent forecasts are anything to go by, it looks set to become the only economy in the world to see positive economic growth in 2020. But how did the Chinese recover so quickly from the Covid-19 crisis, and what does it mean for investors?

Read MoreThe grab for yield

The stratification between the real economy and the stock market continued this week as the Dow Jones Industrial Average, an index of thirty large US companies, reached a record high of 30,000 points. Donald Trump was quick to laud the stock market’s performance as being the result of his economic genius, a welcome break from claiming election fraud, no doubt.

Read MoreLifting the lid

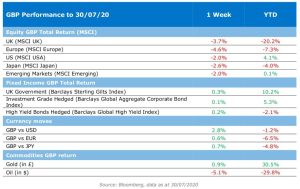

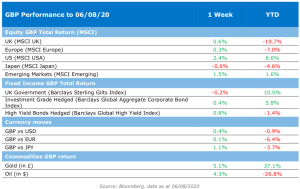

The decision to reinstate a two-week quarantine on travellers returning to the UK from Spain was made this week as the infection rate in the region is running at three times the rate in the UK. As next week sees the start of discounted eating out throughout the country, it appears that holiday goers to the Canary Islands can also snap up the bargain of four weeks of holiday for the price of two! Or at least we think that’s how it works

Read MoreWaiting out the storm

For the first time in history, the price of gold topped $2,000 an ounce as investors continue to look to the safe

haven metal amid the pandemic. The gold rush continues as the US prints money at an aggressive rate,

instigating fears amongst investors that the reserve currency status of the dollar might be under threat.

Reaping the rewards

Russian President Vladimir Putin has said that a locally developed vaccine for Covid-19 has been given regulatory approval after less than two months of testing on humans. Experts were quick to raise concerns about the speed of Russia’s work, and a growing list of countries have expressed scepticism. Personally, we won’t be lining up for a jab just yet.

Read MorePUBLICATIONS

COMMENTARY

We bring you current commentaries to unpack areas of interest in the financial sector