The magnificent Chinese recovery

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

The magnificent Chinese recovery

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

The irony will not be lost on many. If China’s recent forecasts are anything to go by, it looks set to become the only economy in the world to see positive economic growth in 2020. But how did the Chinese recover so quickly from the Covid-19 crisis, and what does it mean for investors?

China operates a so-called ‘centrally planned economy’, where a great deal of government influence is exercised over the manufacturing and distribution of goods and services. A recent example of the control the Chinese government has over business is its intervention in the much-anticipated issuance of shares (known as an initial public offering or IPO) in Ant Group – a Chinese fintech company. Just days before the IPO was due to complete, Chinese authorities stalled proceedings, citing the need for Ant Group to raise more capital to back its lending, rather than relying on banking partners.

In normal conditions, this approach can hold back an economy. In the case of Ant Group, for example, this decision might slash the company’s value by as much as $140 billion.[i] On a macro level, when a central authority attempts to understand the needs and wants of a large and diverse population, it can often end up producing goods and services that are not actually in demand at all. This can lead to inefficiency and waste.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

A remarkable economic recovery

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

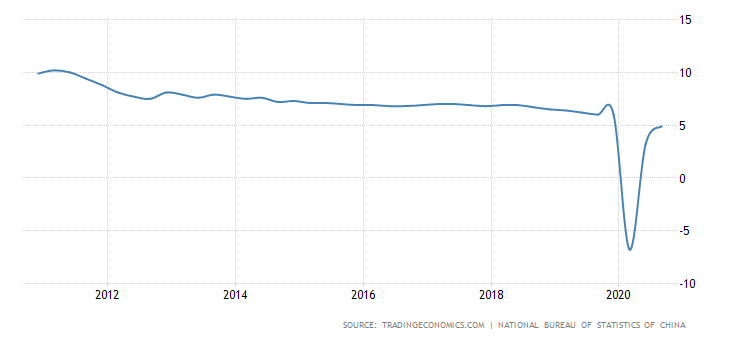

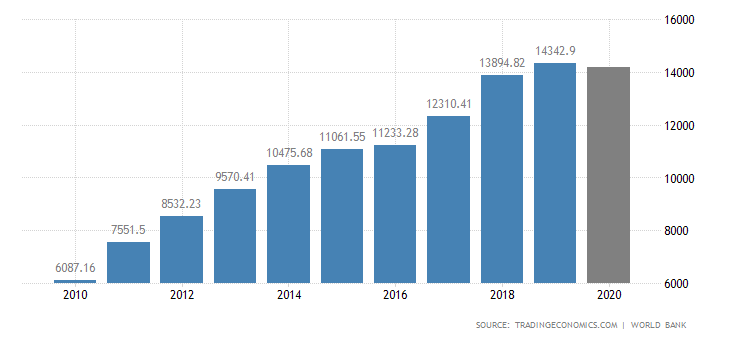

Arguably, though, there are times when having central control over manufacturing and trade can pay off, and perhaps a global pandemic is one of them. The recent economic bounce-back in China is especially surprising given that the country was the epicentre of Covid-19, with a large and densely packed population – many of whom work in confined conditions. But the recovery is undeniable when looking at China’s gross domestic product (GDP), which is defined as ‘the total monetary value of all the finished goods and services produced within a country’s borders in a specific time period’. Economists like to use GDP as a measure of how an economy is faring, and, as the charts below show, China isn’t doing too badly at all.

Chart 1 – Growth in GDP

Chart 2 – Actual GDP over 10 years

This contrasts with much of the Western world. While GDP growth is also recovering in the US, its absolute GDP is at 2018 levels, while in the UK, it is at its lowest level since 2010.

There are several reasons why China appears to have recovered so quickly:

- It has been dealing with Covid-19 since November last year – at least four or five months before Europe and the US.

- China’s draconian lockdown measures were quick and effective, which resulted in swift control of the virus, which subdued further waves.

- That has meant the Chinese have been able to get back to work and state-controlled industrial output has been ramped up, exceeding production expectations.

- The government has pumped around $500 billion into the Chinese economy, which is approximately 4 percent of its annual economic output. Much of this is going towards investment in infrastructure and government bonds for pandemic relief.

- Consumer confidence is relatively high, and retail sales, while still behind expectations, rose 3.3 percent in September (versus 0.5 percent in August).

- Chinese tourists are being forced to take domestic vacations. According to China’s Ministry of Culture and Tourism, ‘Golden Week’, which is China’s annual October holiday, saw 637 million trips, generating revenue of nearly £54 billion.

- There was a rebound in exports as other parts of the world relaxed their Covid-19 lockdown rules, and the Chinese benefited from record shipments of medical supplies and electronic products.

- Property investment is on the rise, with the market growing 5.6 percent year to date.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

What is the longer-term outlook?

Despite this recovery, it’s not necessarily true that China is out of the Covid-19 woods. Not only is the virus still rampant in other parts of the world and therefore able to spread, but China’s success is traditionally built on tapping into a prosperous Western economy. Since many countries are facing their worst economic crisis since the Great Depression of the 1930s, China will continue to have exposure to this downturn. And, like us, the Chinese also have their own financial recovery package to pay for.

That said, the Chinese economy is adapting. Here are some of the longer-term trends to look out for:

1. Trade relations

Putting current trade relations with the US aside, the so-called ‘Belt and Road’ initiative is designed to deepen trade links with other countries by investing in infrastructure and opening trade routes across Asia, Europe and Africa. According to the Chartered Institute of Buildings, it could boost the world economy by over $7 trillion per annum by 2040,[i] with the UK among the top 10 beneficiaries. Sceptics, however, worry that this Chinese initiative is about global control and a bid to replace the US dollar as the world’s reserve currency. Either way, it is likely to yield opportunities for investors and businesses alike.

2. The Chinese Communist Party (CCP) five-year plan

The CCP recently announced a plan for the party to take more control over private business in China, creating a united front between private enterprise and government business. Clearly this will have an impact on investors as the possibility of government interference rises.

3. Change of economic focus

China is slowly shifting from a manufacturing to a service economy as its people become wealthier and demand grows for new goods and services such as financial services, retail and entertainment. The Chinese government wants to become less reliant on overseas markets and technology and has unveiled a ‘dual-circulation strategy’ whereby it will develop a domestic cycle of supply and demand. At the same time, its ‘Made in China 2025’ strategy is shifting the country from being the world’s producer of low-tech cheap goods, to being a technology powerhouse.

4. Technology and security

Increasing a country’s productive capacity moves it up the value chain, and this can certainly be said for China, which is moving from producing large amounts of steel to vast numbers of iPhones (for example). The government made a conscious decision to catch up with the West in telecommunications, and the Chinese are now arguably ahead in these technologies. And they don’t intend to stop there. Later this year, the government is expected to provide detail on the ‘China Standards 2035’ initiative – an ambitious plan to set the global standard for the next generation of technology. No wonder the US is nervous.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_image_id=”” background_color=”#0075c9″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”” box_shadow_spread=”” box_shadow_color=”” box_shadow_style=”” padding_top=”15px” padding_right=”10px” padding_bottom=”0px” padding_left=”10px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

The Sanlam View

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

In any market there are always opportunities, but as investors, we need to be careful when investing in China. The recent events with Ant Group are a stark reminder of that. While the US and UK governments will protect shareholders, the Chinese will do what suits them, so we must always be mindful of that risk. At times, it’s a difficult balance to strike. Chinese companies are well positioned for a post-Covid world and have performed well throughout the crisis. And on a macro-economic level, it’s clear that China will continue to be a force to be reckoned with – especially if it pulls off its trade ambitions, and builds its own domestic economy in a sustainable and progressive way.

We have rotated portfolios away from companies that earn revenue in US dollars from US consumers and have instead invested in businesses that rely on consumers of nations with trade surpluses. Emerging markets, such as China, are an excellent way to achieve this. With the US election result almost certainly marking the end of Trump’s foreign-policy stance, Chinese multinationals will have an increased opportunity to export their goods on the international market. As China leads the way out of the Covid-19 recovery and its population returns to normality, we see exposure to this increasingly wealthy consumer base and world-leading technology as being key drivers in portfolios.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]