News

UK house prices hit an all-time high

UK house prices hit an all-time high this week as pent up demand fuelled the largest monthly rise in 16 years. The average home in the UK is now worth over £224,000, 3.7% more than they were last August.

Read MoreA complex investment landscape as valuations rise and returns fall

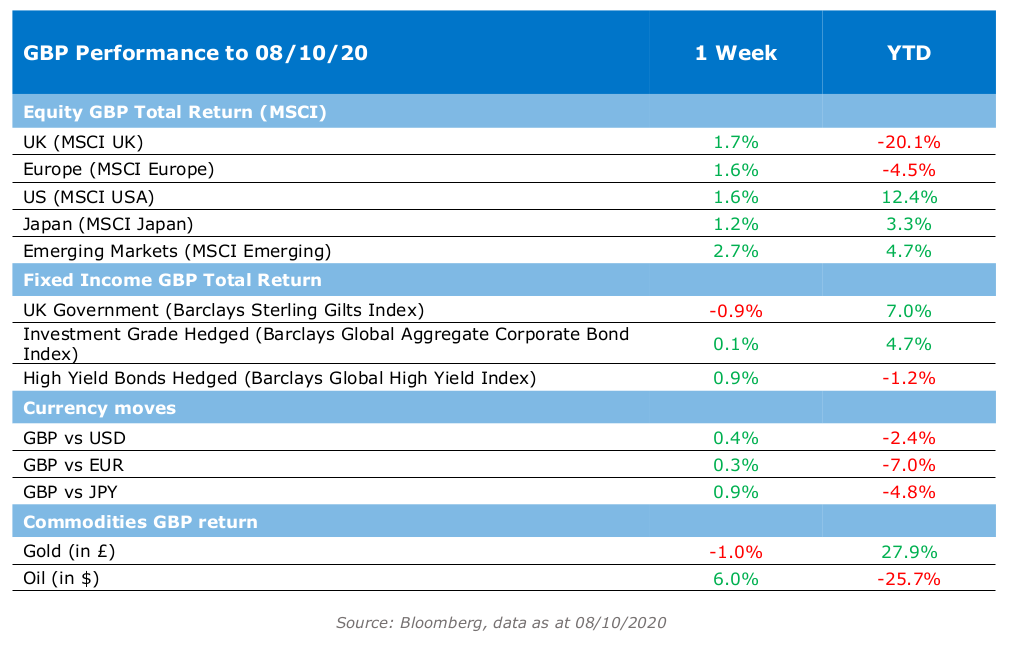

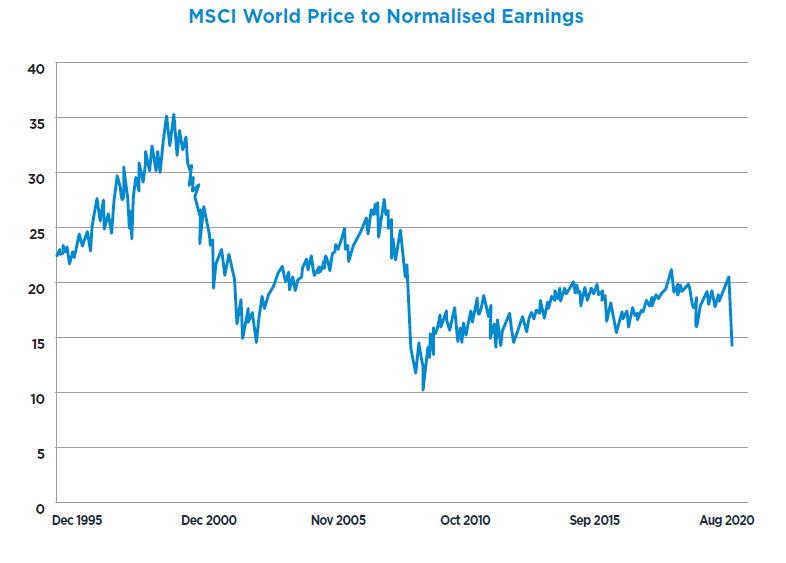

Equity and fixed income markets sustained their remarkable recovery last month thanks to continued government funding. But as prices rose, potential returns fell, and value became harder to find.

Read MoreLooking Micro, Thinking Macro

Volatility in the tech sector continued this week, taking the froth out of some rich valuations. Investors are

grappling with the recent market turbulence, assessing whether the pullback for equities is a sign of market

health or the start of a larger drawdown that has further to go.

Rational markets and innovative central banks? An investor’s guide to the crisis, with Phil Smeaton

Our Chief Investment Officer Philip Smeaton, CFA spoke to Christian May at City AM this morning about how markets have behaved in recent months and the forces that could shape them over the rest of the year.

Read MoreThe shifting sands of sentiment

President Trump returned to the Oval Office on Wednesday, less than a week after contracting Coronavirus. He has since described his illness as “a blessing from God”, saying “I learned by really going to the school and this is the real school and this isn’t the read the book school. And I get it and I understand it”. Markets wait with baited breath to discover what he might do with this newfound self-declared wisdom.

Read MoreThe case for multi-strategy investing

In a world where traditional asset classes aren’t offering particularly attractive prospective returns, many argue that investment in alternative assets – such as private equity, high-yield bonds, renewable energy and even cryptocurrencies – has become essential to ensure sufficient portfolio diversification.

Read MoreEconomies playing catch up

For those of you who’ve spent the last few months of lockdown wishing you had a second house by the sea, now is the time to go out and buy it! UK Chancellor Rishi Sunak has announced a series of Coronavirus recovery measures including job retention bonuses for employers, a £2bn scheme to create jobs for young people and a temporary change to stamp duty. These measures may alleviate short-term pressures but are unlikely to change the longer term dynamics of the economic recovery.

Read MoreCoronavirus special: counting the cost and looking ahead

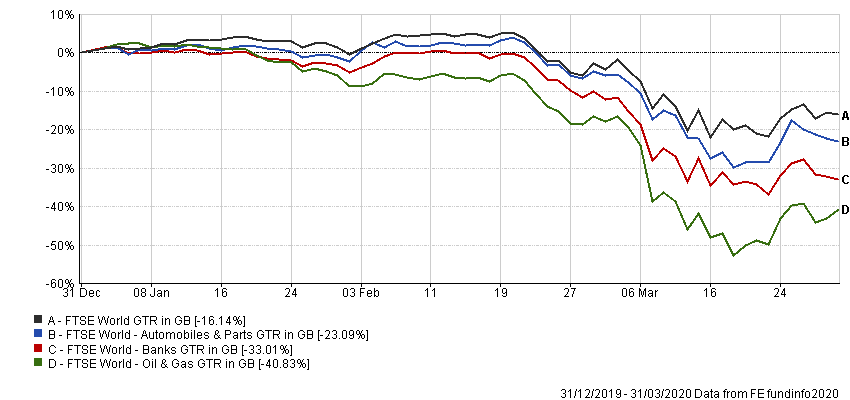

As far as equity markets are concerned, the development of the coronavirus crisis has been as rapid as it has been unprecedented.

Read MoreA cacophony of noise

We remain in a relative news vacuum, but reporting season is slowly getting underway, starting with US banks this week. These companies reported making loan loss provisions (money set aside as an allowance for potentially unpaid debts) but were held up by increased trading revenue due to activity in the fixed income market as investors snapped up bargains.

Read MoreSanlam’s Fourie: Why I’m happy to underperform when the market recovers

There is a strong chance that beaten-up sectors such as energy and financials will lead the eventual recovery from the coronavirus crash, according to Sanlam’s Pieter Fourie – but the manager said this is not enough to convince him to buy into these areas of the market.

Read More