Equities: Looking through the cycle

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Equities: Looking through the cycle

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

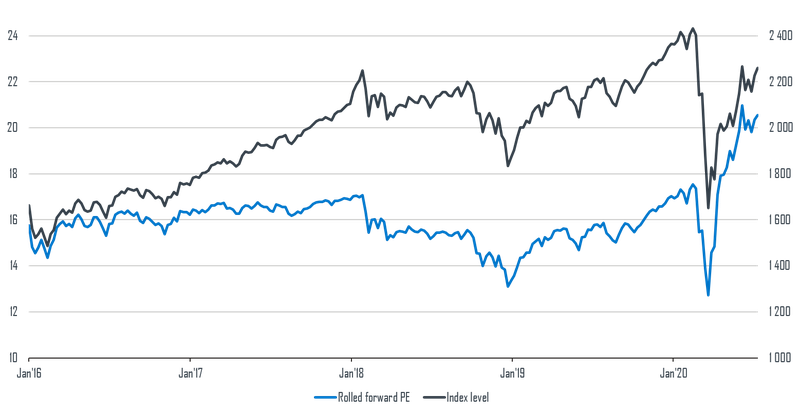

The world is a rather unpredictable place at the moment. While equity markets are up by a whopping 40% since the March 2020 lows, the outlook for the global economy remains uncertain. All major economies except China are expected to contract by more than 5% this year. This will undoubtedly result in substantial declines in company profits, which begs the question: why should an investor continue to hold equities? In our view, it’s crucial not to get too caught up in shorter-term challenges – at Sanlam Private Wealth we take a through-the-cycle approach when valuing companies.

Read more below or listen to David’s views here:

[/fusion_text][fusion_youtube id=”wRsYDV237dQ” alignment=”center” width=”” height=”” autoplay=”false” api_params=”&rel=0″ hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” css_id=”” /][fusion_separator style_type=”none” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” sep_color=”” top_margin=”20px” bottom_margin=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” /][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

The world is a rather unpredictable place at the moment. While equity markets are up by a whopping 40% since the March 2020 lows, the outlook for the global economy remains uncertain. All major economies except China are expected to contract by more than 5% this year. This will undoubtedly result in substantial declines in company profits, which begs the question: why should an investor continue to hold equities? In our view, it’s crucial not to get too caught up in shorter-term challenges – at Sanlam Private Wealth we take a through-the-cycle approach when valuing companies

At Sanlam Private Wealth, we agree with the market’s current logic of looking beyond the short-term difficulties. Our philosophy seeks to look through the cycle and assess companies’ sustainable earnings levels. We then value companies based on what they can deliver consistently over time, and seek to take advantage of mispricing when the market is either too optimistic, or too pessimistic.

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

3 KEY QUESTIONS

The three high-level questions we’re currently asking are:

- Will companies, on average, return to their pre-COVID-19 earnings levels?

- If so, how long will it take for this to happen?

- How do the answers to these two questions impact the valuations of companies?

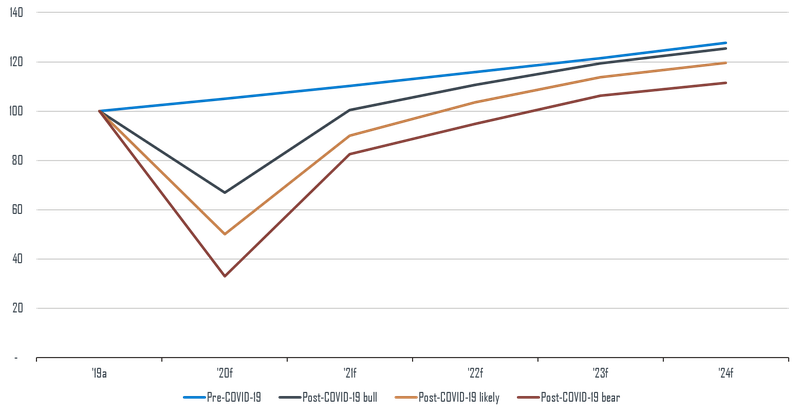

Some companies, like Amazon, will benefit from the COVID-19 pandemic, while others, like certain airlines, will go bankrupt. This leaves a large ‘middle ground’ – the earnings profile of an average company in this territory is illustrated below:

If we assume that a hypothetical average company, Acme Industries, made R100 profit in 2019, the pre-COVID-19 base-case assumption would have been for profit of around R105 in 2020, rising at, say, 5% per year. While the exact COVID-19 impact in 2020 is uncertain, we do know that it’s distinctly negative for Acme. We set a base-case assumption of a 50% decline in earnings in 2020.

The likely scenario would then be a sharp recovery in profits in 2021 off the low 2020 base as lockdowns are lifted. But given the overall contraction of the economy in 2020, demand, sales and profits in 2021 should still be below pre-COVID-19 levels.

There are differing views on how quickly the economy will recover after the pandemic, but the key point is that the gross domestic product (GDP) base has been set lower, as would be the case for the so-called average company. As illustrated in the ‘likely’ scenario above, we would expect Acme’s 2024 earnings to still be about 6% below the pre-COVID-19 expectation for that year. Under our bear-case scenario, this could be as much as 12% below the pre-pandemic expectation.

The exact numbers are less important than the concept: economies and company earnings will recover in time, but won’t hit the levels expected of any given year that were baked into valuations before the emergence of COVID-19. Acme would likely return to 2019 earnings levels only in 2021.

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

IMPACT ON VALUATION

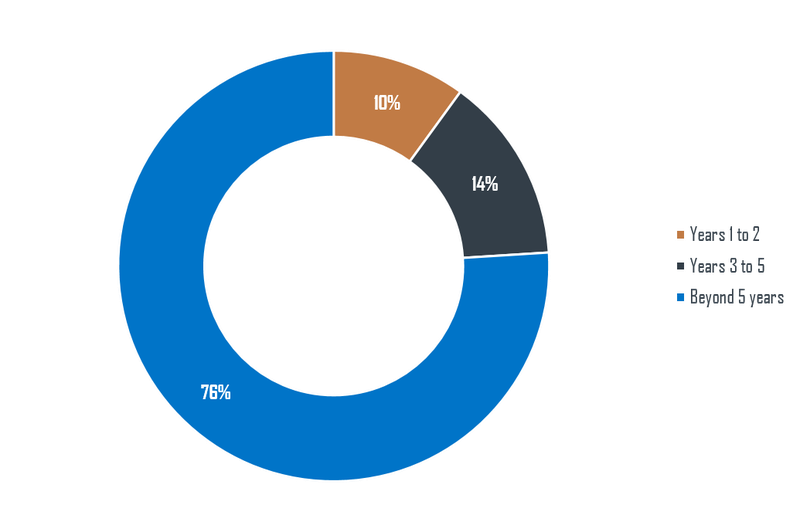

How does this impact Acme’s valuation? Remember, the value of a company is simply the sum of that company’s future earnings, discounted back to today.

The ‘likely’ scenario above (the light brown line) would result in a 10% reduction in the discounted cash flow valuation (DCF) of Acme Industries relative to one based on pre-COVID-19 estimates. We use DCF because it takes into account the company’s expected cash profit over many years, not just over the short term.

When calculating a DCF valuation, typically around three quarters of a company’s value would come from expectations beyond year five. By contrast, only 10% would come from the first two years, as shown in the chart below:

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_image_id=”” background_color=”#0075c9″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”” box_shadow_spread=”” box_shadow_color=”” box_shadow_style=”” padding_top=”15px” padding_right=”10px” padding_bottom=”0px” padding_left=”10px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

LONG-TERM OUTLOOK CRUCIAL

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

It’s clear that long-term expectations are more important in valuing a company than the short-term outlook. Valuations based on one-year forward earnings would be inappropriate where they’re not representative of sustainable longer-term expectations. In the COVID-19 crisis, we view short-term earnings as being below sustainable levels. We would, however, apply the same logic to a situation in which short-term earnings appear unsustainably high (for example, we expect long-term iron ore prices to be below current levels, and we value BHP accordingly).

The market has shown a remarkably quick return to rationality since the panic in March 2020 – governments acted quickly to provide stimulus and investors took the view that the pandemic will be short-lived. Our base-case view is that markets should be trading at around 10% below their pre-COVID-19 levels – in our view, they’re currently trading at levels more expensive than our calculated fair value. Although we continue to look through the cycle and beyond the short-term challenges when we value companies, we therefore recently reduced the equity exposure in our multi-asset portfolios from overweight to underweight.

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Author: DAVID LERCHE (Senior Investment Analyst)

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]