News

UK house prices hit an all-time high

UK house prices hit an all-time high this week as pent up demand fuelled the largest monthly rise in 16 years. The average home in the UK is now worth over £224,000, 3.7% more than they were last August.

Read MoreA complex investment landscape as valuations rise and returns fall

Equity and fixed income markets sustained their remarkable recovery last month thanks to continued government funding. But as prices rose, potential returns fell, and value became harder to find.

Read MoreLooking Micro, Thinking Macro

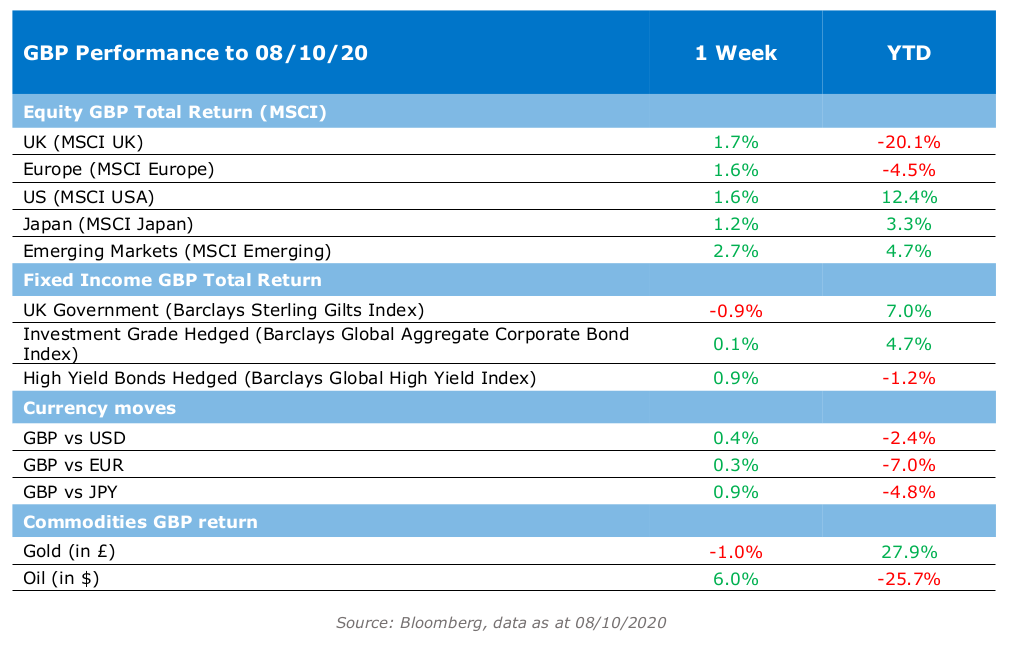

Volatility in the tech sector continued this week, taking the froth out of some rich valuations. Investors are

grappling with the recent market turbulence, assessing whether the pullback for equities is a sign of market

health or the start of a larger drawdown that has further to go.

Rational markets and innovative central banks? An investor’s guide to the crisis, with Phil Smeaton

Our Chief Investment Officer Philip Smeaton, CFA spoke to Christian May at City AM this morning about how markets have behaved in recent months and the forces that could shape them over the rest of the year.

Read MoreThe shifting sands of sentiment

President Trump returned to the Oval Office on Wednesday, less than a week after contracting Coronavirus. He has since described his illness as “a blessing from God”, saying “I learned by really going to the school and this is the real school and this isn’t the read the book school. And I get it and I understand it”. Markets wait with baited breath to discover what he might do with this newfound self-declared wisdom.

Read MoreThe case for multi-strategy investing

In a world where traditional asset classes aren’t offering particularly attractive prospective returns, many argue that investment in alternative assets – such as private equity, high-yield bonds, renewable energy and even cryptocurrencies – has become essential to ensure sufficient portfolio diversification.

Read MoreSanlam to manage world’s first active global equity Shariah compliant ETF

Later this week, the international financial services group, Almalia, will launch the world’s first active global equity Shariah compliant ETF. The Almalia Sanlam Active Shariah Global Equity UCITS ETF (the ETF) will launch via the HANetf platform and will list on the London Stock Exchange later this week.

Read MorePresident Trump makes more headlines

President Trump has made multiple headlines this week, firstly on Sunday after the New York Times reported that the president paid $750 of income tax in both 2016 and 2017. The first presidential debate ahead of the November US election then descended into childish bickering and finally, confirmation came last night that the President and First Lady have both tested positive for Coronavirus.

Read MoreThe importance of careful stock-picking

Equity prices have recovered from the lows in March – a remarkable comeback amid so much uncertainty. But high valuations mean less opportunity for future returns and more risk for investors, so where do we go from here?

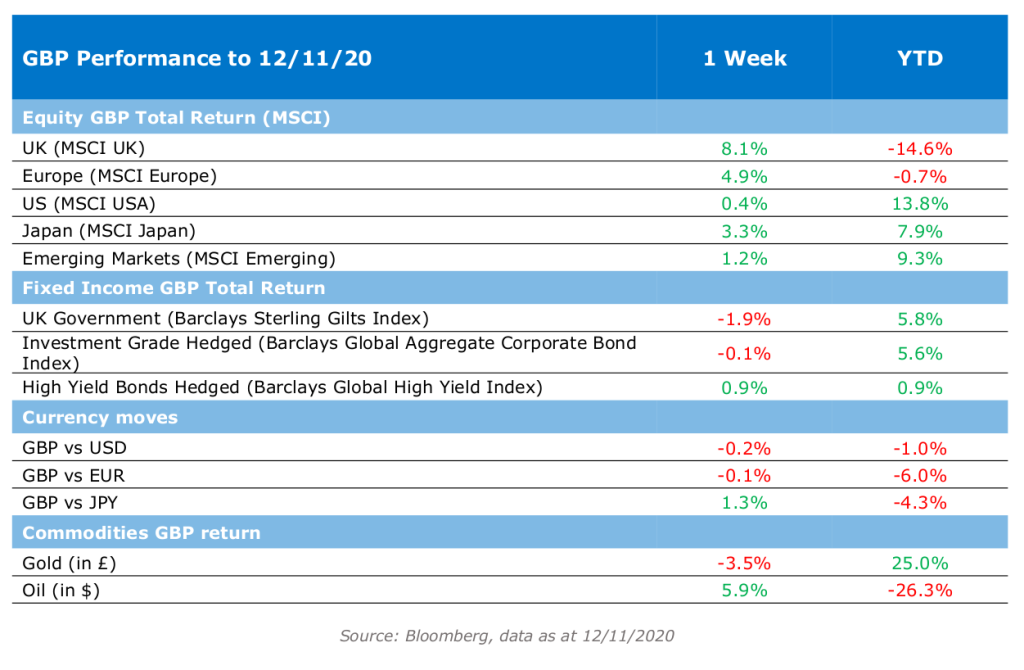

Read MoreValue returns, Cummings goes

This week has heralded a significant change in tone for markets. After months of outperformance by tech stocks such as Amazon, Apple and Microsoft, the

tides changed this week and many investors found themselves wrong-footed by the switch in sentiment. With Pfizer’s vaccine news providing a glimmer of

hope for a return to normality, cyclical stocks in industries such as travel, banking and hospitality staged a significant rally.