News

Short-Term Noise, Long-Term Investing

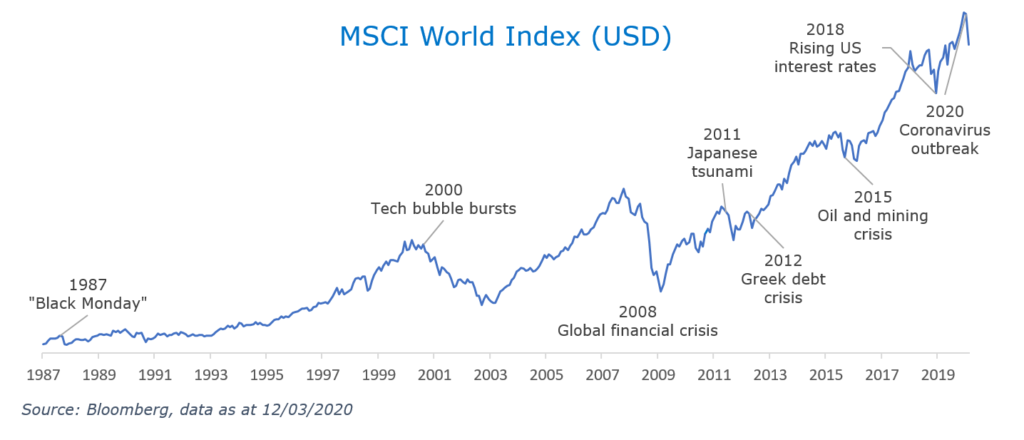

In the wake of last Monday’s mass movement in global markets, prices have continued to plummet in response to the further announcement of Coronavirus-related news.

Read MoreWhen markets move in mysterious ways

The world has been coming to terms with the implications of the coronavirus for some weeks now, but it was only towards the end of last month that we experienced the level of volatility we would expect in equity markets given a crisis of this scale.

Read MoreMauritius removed from the OECD’s list of countries operating potential high-risk Residence/Citizenship by Investment Schemes

The Economic Development Board of Mauritius (EDB) is informing the general public and the international investor community that Mauritius has been removed from the initial list of countries published by the OECD.

Read MoreMarket Turbulence Investment Update

In the midst of what has been an extraordinary period of market volatility, please see below a video update from our Chief Investment Officer, Phil Smeaton, in which he discusses what has happened in global investment markets of late, what it means for us as investors and why now is a bad time to panic.

Read MoreGlobal Markets – What to expect in 2019

Join Sanlam Private Wealth and the South African Chamber of Commerce on the 29 January 2019 at 08am for a presentation by Pieter Fourie, Fund Manager of the award-winning Sanlam Global

High Quality Equity Fund. Pieter will give an insightful overview on Global Equities and how to navigate volatility using a proven high quality approach.

Markets stabilise after unprecedented stimulus

After weeks of falling asset prices, markets have started to recognise the value in beaten down stocks. Volatility has declined whilst both equity and bond markets have stabilised slightly.

Read MoreOnus placed on monetary policy to avoid recession

Pressure is building on central banks to lower interest rates and help the global economy stave off the threat of recession. The European Central Bank (ECB) failed to deliver a rate cut in July, but the US Federal Reserve (Fed), after much talk, finally ‘walked the walk’ on the last day of the month and reduced interest rates for the first time since 2008.

Read MoreThe SA downgrade and your investment

Like many developing countries, the South African government relies on funding to build and maintain the infrastructure of the country. To enjoy continued access to loans (in the form of government bonds) at affordable interest rates, it’s important that we keep our credit rating healthy.

Read MoreSanlam Real Assets Fund Celebrates First Birthday

Today, the Sanlam Real Assets Fund reaches its first birthday.

Managed by Mike Pinggera and his team, the Fund was launched in response to demand from existing investors for increased exposure to real assets; a key component of the award winning Sanlam Multi-Strategy Fund since its launch in 2013.

Read MoreRisks are inevitable and not to be feared

Towards the end of last month, we took another step closer to a ‘no deal’ Brexit with the approval of a suspended parliament in September. While critics declared it a ‘constitutional outrage’, it was the latest twist in what has been an extraordinary political saga. As several risk factors converge (Brexit, US-China trade war, the threat of recession and inflation concerns), the outlook for the remainder of 2019 is unquestionably opaque. But to what extent should investors worry? Here we discuss the risks at large, and why they are not necessarily to be feared.

Read More