Short-Term Noise, Long-Term Investing

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Short-Term Noise, Long-Term Investing

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

What is Happening?

In the wake of last Monday’s mass movement in global markets, prices have continued to plummet in response to the further announcement of Coronavirus-related news. Investors have reacted dramatically to President Trump’s announcement that all travel from Europe (excluding the UK) to the US will be suspended for 30 days. This major intervention is in response to the World Health Organisation officially declaring the Coronavirus outbreak as a pandemic yesterday. The FTSE 100 has dropped 9% at the time of writing as panic-induced mass-selling continues to push markets to new lows. Now more than ever it is imperative that investors avoid making decisions motivated by fear. As we emphasised last week, the importance of staying invested cannot be overstated, even as markets continue to plunge.

Why should investors stay invested during turbulent times?

Put simply, because doing so can give you an edge when it comes to seizing new opportunities as prosperity returns.

Those that have seen the film The Big Short will know that only a small number of people predicted the 2007 economic crash, and the same is true of the tech bubble bursting at the end of the 20th century. While most investors didn’t foresee either event, many of those who held their nerve during the ensuing turbulence on the financial markets saw impressive gains when values rebounded.

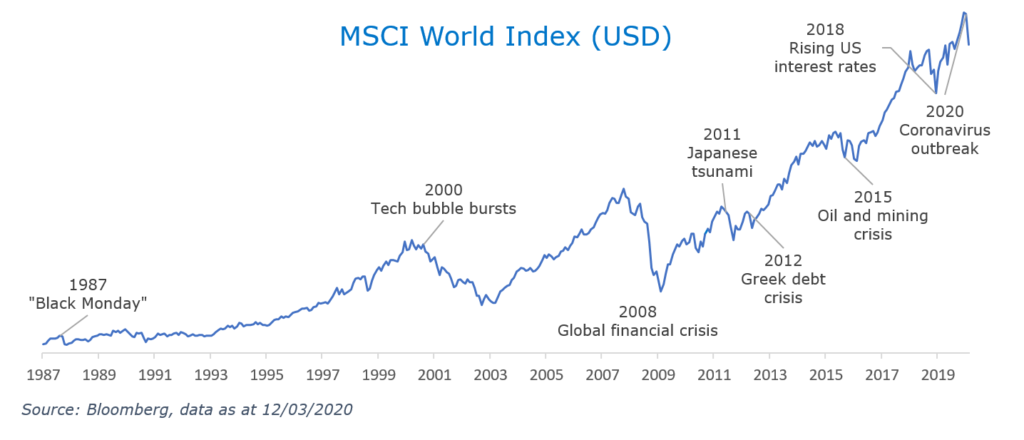

A quick glance at the history of the MSCI World Index since 1980 shows us that the best strategy is often just to leave your investment where it is during periods of crisis – the aftermath of each has seen markets exceed pre-crash values. After all, everything from Black Monday in 1987 to the Greek debt crisis caused panic at the time, yet their impact is now barely remembered by many investors.

But weathering the initial storm requires personal discipline and resilient portfolios. Diversifying across sectors and regions, while considering such issues as competitor and regulatory risk, and company debt, can limit the impact of a market fall. The problem for most private investors is that they lack the time, discipline and expertise to do this themselves.

What has happened when markets have dropped this drastically in the past?

In December 2018 equities fell by about 20% because of concern about rising interest rates in the US. They subsequently bounced back, so if you’d sold investments in December you would have missed out on the rebound.

You would then have had a very difficult decision to make – if the market keeps going up, do you just never buy back in or how long do you wait?

The European sovereign debt crisis is another interesting example. At the time, global markets would gyrate in sympathy as the political noise reverberated through the news headlines. Speculation as to whether the Greek crisis would cause contagion was rampant, but ultimately what happened was that some Greek debt got written off and Greek gross domestic product collapsed as austerity was imposed. However, the wider world just moved on, and if you were investing globally, while Greece might have rocked your portfolio for a couple of days here and there, you probably won’t even really remember it.

How can investors position themselves to be as resilient as possible in these volatile times?

To ensure portfolios are as robust as possible to deal with an initial shock, we carry out ongoing research, reading company financial statements to look for signs of strength or weakness, attending company presentations and webcasts, and studying global news reports and economic data to assess how the changing political or economic situation could affect companies.

Researching and truly understanding the investments you have in a portfolio is what arms you to make the right decisions when required. Analysing how different investments interact with each other and broad macroeconomic risks allows us to craft portfolios with the right level and type of diversification to minimise the impact of major market shocks. For example, there are lots of different healthcare companies and you might say, well, healthcare is healthcare.

But there’s a big difference between a company with a costly R&D department researching new pharmaceuticals that take a decade to patent, test, secure regulatory approval and bring to market, compared to a company that sells medical equipment like scissors or surgical gloves. Drug companies have significantly more political risk than medical device companies, and the portfolio’s exposure to these risks needs to be understood and controlled. That’s not to say those companies are good or bad, but they are more affected by the political narrative.

“The market is sometimes irrational and panics about things, but every time that’s ever happened, it has always corrected itself.”

What warning signs should investors be on the lookout for and what changes can be made to portfolios in response to these uniquely difficult market conditions?

While we monitor a range of risks that could lead to investment managers adjusting portfolios, there are two that are always front of mind. The first is shifting political sands that can have an impact on the way companies operate. The second is the risk of financial distress that companies might experience because financing is no longer available to them. This can be caused by any number of things, such as rising interest rates that make the cost of refinancing too high or because investors have become skittish and are reluctant to offer credit to companies on cheap terms.

One of the key ways of adjusting portfolios when markets become more difficult is to invest in companies with strong balance sheets and without excessive leverage.

If you want to protect yourself from a once in a 100-year event then companies with strong balance sheets and net cash are well positioned. Highly leveraged companies are vulnerable to slowing growth as they have assumed an expanding economy will enable them to pay down the debt. It’s a bit like the homeowner who has stretched themselves to buy a house they can’t afford, only to be told by their employer that there is only enough work for four days a week. In contrast, strong companies often benefit as their weaker or foolish competitors struggle.

We favour, through all times, companies that have strong balance sheets because we think the flexibility and resilience that this provides is inherently a good thing. But in times when we are more concerned with economic weakness and leverage might be a problem, we place even more emphasis on those companies.

What do we know and how should we be thinking?

Ultimately, we can predict some things that will happen in the markets but not others. As the tongue-twisting former US Secretary of Defense Donald Rumsfeld once said: “There are things we know that we know. We also know there are known unknowns; that is to say, we know there are things that we do not know. But there are also unknown unknowns – the ones we don’t know we don’t know.

The important thing for investors is to be disciplined. Yet people often fail to act rationally and may need support from those who can guide them and prevent them from selling out just as the market bottoms out, missing out on long-term gains. This was borne out by Nobel Prize-winning economist Daniel Kahneman and Amos Tversky, who found that people were more likely to avoid losses than chase gains.

It is always possible to have a short-term loss from time to time because the market is sometimes irrational and panics about things, but every time that’s ever happened, it has always corrected itself.

But as our graph shows, there have been no overall losses in the MSCI index since 1980. The real issue is that no one can predict when the market is going to be irrational, yet many investors tend to focus too much on short-term risks that never manifest. Being too worried about such issues leads to the greater risk of not participating in market gains, which is why it’s important to talk to a financial adviser.

Past performance is not a reliable indicator of future results. Investing involves risk and the value of investments, and theincome from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]