Posts by adminsam

Lifting the lid

The decision to reinstate a two-week quarantine on travellers returning to the UK from Spain was made this week as the infection rate in the region is running at three times the rate in the UK. As next week sees the start of discounted eating out throughout the country, it appears that holiday goers to the Canary Islands can also snap up the bargain of four weeks of holiday for the price of two! Or at least we think that’s how it works

Read MoreRational markets and innovative central banks? An investor’s guide to the crisis, with Phil Smeaton

Our Chief Investment Officer Philip Smeaton, CFA spoke to Christian May at City AM this morning about how markets have behaved in recent months and the forces that could shape them over the rest of the year.

Read MoreLooking Micro, Thinking Macro

Volatility in the tech sector continued this week, taking the froth out of some rich valuations. Investors are

grappling with the recent market turbulence, assessing whether the pullback for equities is a sign of market

health or the start of a larger drawdown that has further to go.

The grab for yield

The stratification between the real economy and the stock market continued this week as the Dow Jones Industrial Average, an index of thirty large US companies, reached a record high of 30,000 points. Donald Trump was quick to laud the stock market’s performance as being the result of his economic genius, a welcome break from claiming election fraud, no doubt.

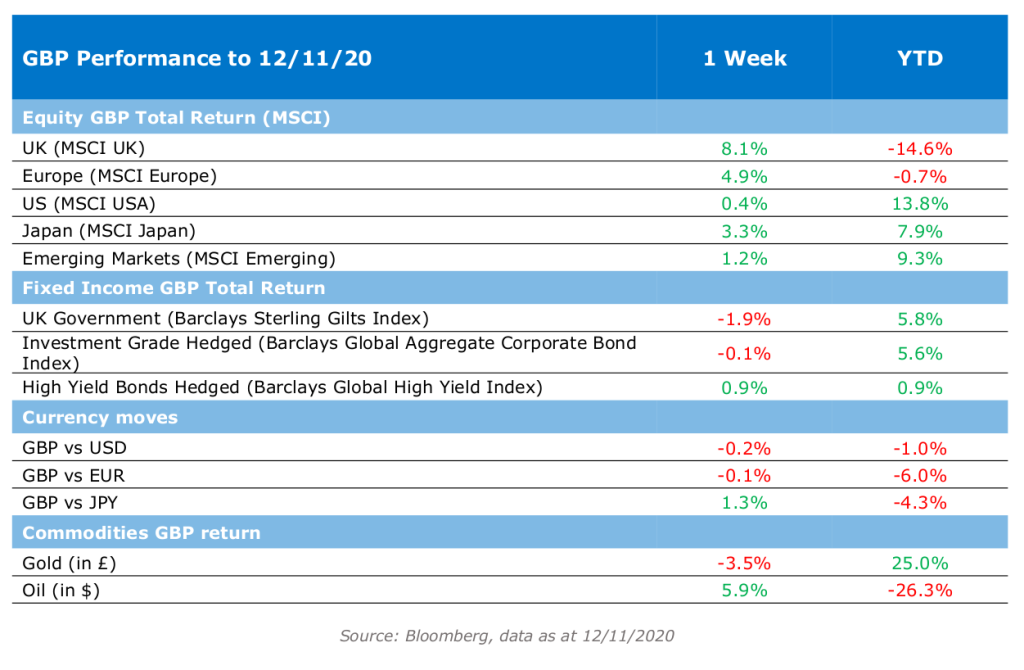

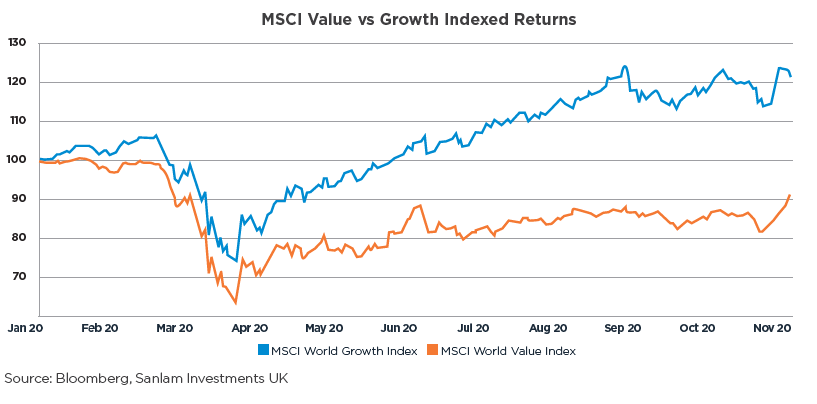

Read MoreValue returns, Cummings goes

This week has heralded a significant change in tone for markets. After months of outperformance by tech stocks such as Amazon, Apple and Microsoft, the

tides changed this week and many investors found themselves wrong-footed by the switch in sentiment. With Pfizer’s vaccine news providing a glimmer of

hope for a return to normality, cyclical stocks in industries such as travel, banking and hospitality staged a significant rally.

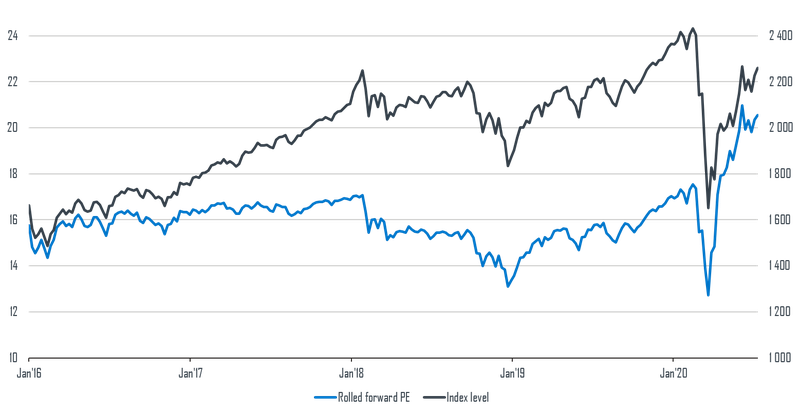

Equities: Looking through the cycle

The world is a rather unpredictable place at the moment. While equity markets are up by a whopping 40% since the March 2020 lows, the outlook for the global economy remains uncertain. All major economies except China are expected to contract by more than 5% this year.

Read MoreThe promise of a vaccine sees value stocks turn a corner

When equity markets rallied 8 percent on the announcement of BioNtech and Pfizer’s Covid-19 vaccine, it showed just how eager investors were for some light at the end of the tunnel. But as global lockdowns persist, it’s clear we’re not out of the woods yet, and markets pulled back again to reflect that.

Read MoreThe importance of careful stock-picking

Equity prices have recovered from the lows in March – a remarkable comeback amid so much uncertainty. But high valuations mean less opportunity for future returns and more risk for investors, so where do we go from here?

Read MoreReaping the rewards

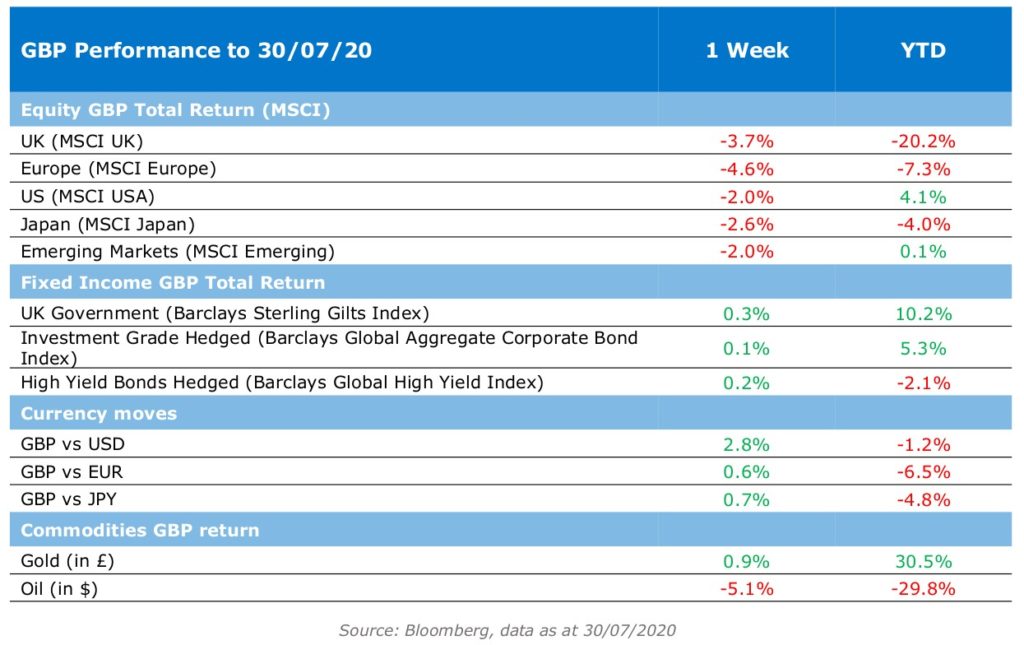

Russian President Vladimir Putin has said that a locally developed vaccine for Covid-19 has been given regulatory approval after less than two months of testing on humans. Experts were quick to raise concerns about the speed of Russia’s work, and a growing list of countries have expressed scepticism. Personally, we won’t be lining up for a jab just yet.

Read MoreWaiting out the storm

For the first time in history, the price of gold topped $2,000 an ounce as investors continue to look to the safe

haven metal amid the pandemic. The gold rush continues as the US prints money at an aggressive rate,

instigating fears amongst investors that the reserve currency status of the dollar might be under threat.