Posts by adminsam

The SA downgrade and your investment

Like many developing countries, the South African government relies on funding to build and maintain the infrastructure of the country. To enjoy continued access to loans (in the form of government bonds) at affordable interest rates, it’s important that we keep our credit rating healthy.

Read MoreMarkets stabilise after unprecedented stimulus

After weeks of falling asset prices, markets have started to recognise the value in beaten down stocks. Volatility has declined whilst both equity and bond markets have stabilised slightly.

Read MoreWhen markets move in mysterious ways

The world has been coming to terms with the implications of the coronavirus for some weeks now, but it was only towards the end of last month that we experienced the level of volatility we would expect in equity markets given a crisis of this scale.

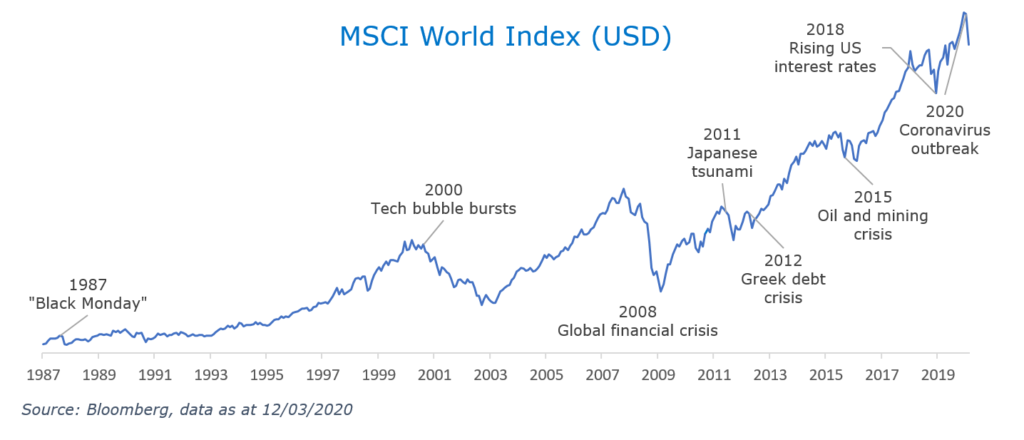

Read MoreShort-Term Noise, Long-Term Investing

In the wake of last Monday’s mass movement in global markets, prices have continued to plummet in response to the further announcement of Coronavirus-related news.

Read MorePieter Fourie awarded Alpha Manager rating for a second year in a row

Congratulations to Pieter Fourie, Head of Global Equities, for picking up an FE fundinfo Alpha Manager rating for a second year in a row.

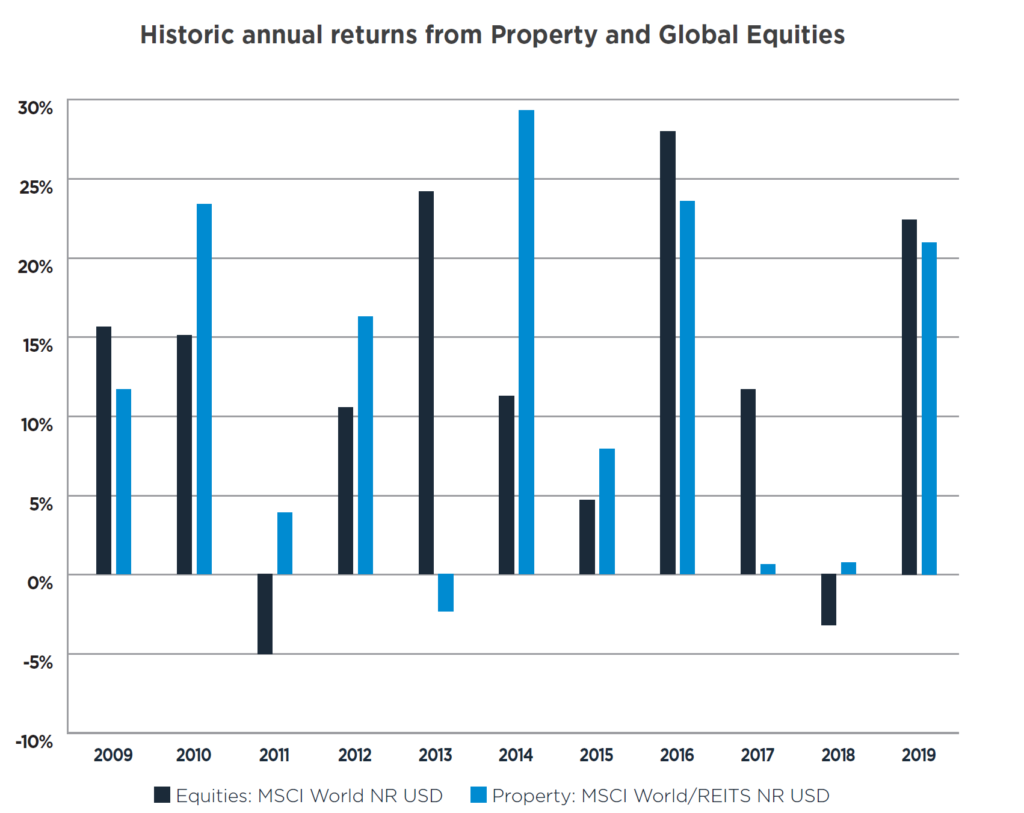

Read MoreInvestors seduced by equity returns

This time last year it was hard to escape the prospect of a global recession. Twelve months later and we are looking forward to a recovery in global economic growth, thanks to progress in finding a US-China trade compromise, and the likelihood that President Trump will be economically supportive leading up to the presidential election in November.

Read MoreAn optimistic end to the year 2019

Having spent much of 2019 worrying about the very real possibility of a global recession, investors are heading into the holiday period feeling slightly more relaxed about the outlook for next year. Interest rate cuts by the Federal Reserve, and an easing of monetary policy around the world, appear to have seen off a full-blown recession in favour of a more palatable slowdown in growth.

Read More6 trends that will define the new decade

An investor’s journey has always been one of facing the unknown in the quest for sufficient reward in return for taking on risk – primarily defined as uncertainty. And increasingly, clarity about the future is becoming rare. As we prepare to enter the next decade we turn to trends that are already visible to understand where our ultimate direction and focus should lie.

Read MoreMarket Turbulence Investment Update

In the midst of what has been an extraordinary period of market volatility, please see below a video update from our Chief Investment Officer, Phil Smeaton, in which he discusses what has happened in global investment markets of late, what it means for us as investors and why now is a bad time to panic.

Read MoreSanlam buys out Saham

Sanlam, SAHAM’s partner since February 2016, will increase its stake in the capital of SAHAM Group’s insurance subsidiary, from 46.6% to 100%, according to the terms of an agreement reached on March 7th, 2018.

Read more on www.businesswire.com

Read More