An optimistic end to the year 2019

An optimistic end to the year

Having spent much of 2019 worrying about the very real possibility of a global recession, investors are heading into the holiday period feeling slightly more relaxed about the outlook for next year. Interest rate cuts by the Federal Reserve, and an easing of monetary policy around the world, appear to have seen off a full-blown recession in favour of a more palatable slowdown in growth.

A promising outlook

Although we must be mindful of the risks associated with a slowing economy, and we don’t yet have a resolution to the US-China trade war, the forward-looking data has stabilised.

The US yield curve is no longer inverted, meaning the yield on long-term US Treasury Bonds is better than for short-term bonds. Given that an inverted yield curve has traditionally been a pre-cursor to recession, this is welcome news.

At the same time, purchasing managers’ indices have stabilised across the G20. This measure gives an idea of the prevailing direction of the wider economy, and we expect the current rate of growth to be sustained. Indeed, the most recent US GDP growth rate of 1.9% is consistent with the potential growth forecast.

The Sanlam view

In times of slower economic growth, some companies will inevitably perform better than others. We continue to focus on well-run businesses that are less dependent on the economic cycle and that can deliver sustainable returns, even if economic growth disappoints.

To enable growth, we expect government spending to intensify – especially since central banks are keeping the cost of borrowing so low. Politicians are pointing to ‘modern monetary theory’ and low bond yields as evidence that the level of government debt doesn’t matter.

We recognise that these conditions could play into the hands of an inflation shock; we therefore continue to invest in inflation-linked bonds, gold and companies that are well positioned to pass on higher costs through price increases in the event of rising inflation.

“We expect moderate economic growth to sustain high levels of employment and generate real wage growth. This will support consumer purchasing power, and financial conditions should remain supportive for business. All in all, a good end to a year of continued uncertainty.” – Philip Smeaton, Chief Investment Officer

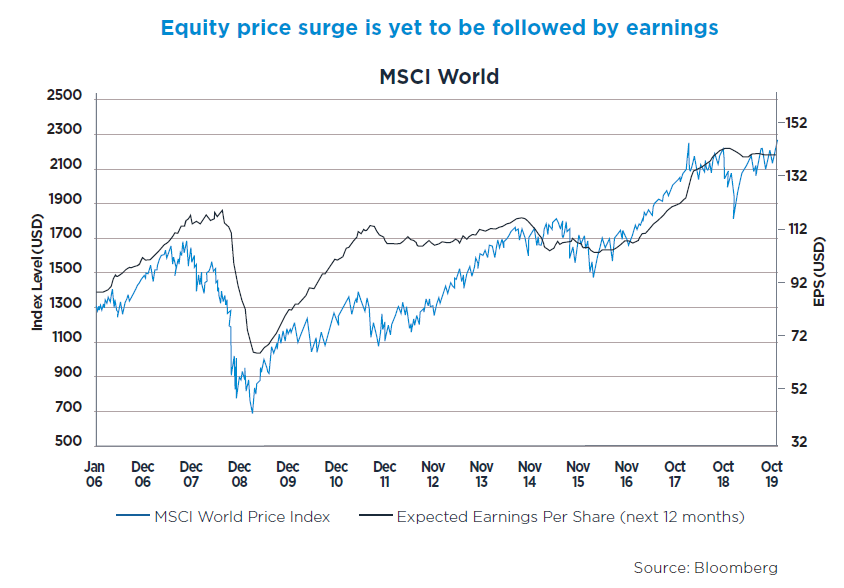

Investment view: company earnings versus share price

Tracking company earnings is fundamental to investing in equities as the two are inextricably linked. As a basic premise, if the general trend for company earnings is upwards or sideways, the economy is doing okay. So, can we assume that share prices will follow suit? Needless to say, if we look back at company earnings versus the share price, we find that it’s not always as straightforward as that. The graph below shows that:

- When markets lack confidence, such as in the aftermath of the credit crunch, equities can track well below company earnings, making them relatively cheap. Conversely, when markets are buoyed with confidence they may track above earnings, making them relatively expensive.

- Share prices can diverge from the earnings that ultimately underpin them, which can make investors nervous. That’s why we prefer to focus on underlying business profits, which compound to generate long-term returns. Doing so means we don’t need to fear any short-term noise and can instead seek to use it to our advantage.

- Despite a year of pessimism and a significant market correction only 12 months ago, prices have already returned to an expensive level relative to earnings. This has meant that broad opportunities for equity investors have been, and remain, few and far between. With such a backdrop in mind, our fundamentals-based approach to active investing, which capitalises on segments of the market that appear undervalued, can prove to be rewarding.

So, what should we make of the recent surge in equity prices that has yet to be followed by earnings? Given that the forecast is for company earnings to remain relatively stable for the time being, we don’t think equities will continue a steep upward trajectory. However, if the UK delivers a market-friendly election result, and the US manages to secure a positive trade deal, then corporate earnings may start to rise once more. As always, nothing is certain, which is why our focus on long-term business fundamentals serves us so well. We would like to wish all our clients and advisers a very Merry Christmas, and a Happy New Year.