NEWS AND

EVENTS

Reaping the rewards

Russian President Vladimir Putin has said that a locally developed vaccine for Covid-19 has been given regulatory approval after less than two months of testing on humans. Experts were quick to raise concerns about the speed of Russia’s work, and a growing list of countries have expressed scepticism. Personally, we won’t be lining up for a jab just yet.

Read MoreA complex investment landscape as valuations rise and returns fall

Equity and fixed income markets sustained their remarkable recovery last month thanks to continued government funding. But as prices rose, potential returns fell, and value became harder to find.

Read MoreThe shifting sands of sentiment

President Trump returned to the Oval Office on Wednesday, less than a week after contracting Coronavirus. He has since described his illness as “a blessing from God”, saying “I learned by really going to the school and this is the real school and this isn’t the read the book school. And I get it and I understand it”. Markets wait with baited breath to discover what he might do with this newfound self-declared wisdom.

Read MoreThe case for multi-strategy investing

In a world where traditional asset classes aren’t offering particularly attractive prospective returns, many argue that investment in alternative assets – such as private equity, high-yield bonds, renewable energy and even cryptocurrencies – has become essential to ensure sufficient portfolio diversification.

Read MoreSanlam to manage world’s first active global equity Shariah compliant ETF

Later this week, the international financial services group, Almalia, will launch the world’s first active global equity Shariah compliant ETF. The Almalia Sanlam Active Shariah Global Equity UCITS ETF (the ETF) will launch via the HANetf platform and will list on the London Stock Exchange later this week.

Read MorePresident Trump makes more headlines

President Trump has made multiple headlines this week, firstly on Sunday after the New York Times reported that the president paid $750 of income tax in both 2016 and 2017. The first presidential debate ahead of the November US election then descended into childish bickering and finally, confirmation came last night that the President and First Lady have both tested positive for Coronavirus.

Read MoreThe importance of careful stock-picking

Equity prices have recovered from the lows in March – a remarkable comeback amid so much uncertainty. But high valuations mean less opportunity for future returns and more risk for investors, so where do we go from here?

Read MoreValue returns, Cummings goes

This week has heralded a significant change in tone for markets. After months of outperformance by tech stocks such as Amazon, Apple and Microsoft, the

tides changed this week and many investors found themselves wrong-footed by the switch in sentiment. With Pfizer’s vaccine news providing a glimmer of

hope for a return to normality, cyclical stocks in industries such as travel, banking and hospitality staged a significant rally.

The grab for yield

The stratification between the real economy and the stock market continued this week as the Dow Jones Industrial Average, an index of thirty large US companies, reached a record high of 30,000 points. Donald Trump was quick to laud the stock market’s performance as being the result of his economic genius, a welcome break from claiming election fraud, no doubt.

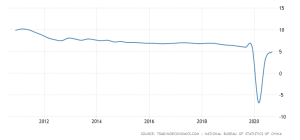

Read MoreThe magnificent Chinese recovery

The irony will not be lost on many. If China’s recent forecasts are anything to go by, it looks set to become the only economy in the world to see positive economic growth in 2020. But how did the Chinese recover so quickly from the Covid-19 crisis, and what does it mean for investors?

Read MorePUBLICATIONS

COMMENTARY

We bring you current commentaries to unpack areas of interest in the financial sector