News

Pushed towards Risk

Earlier this week European leaders crossed the Rubicon and agreed an unprecedented economic programme. The EU have agreed a deal on a €750bn recovery fund to address Covid-19 damage; importantly, all raised by issuing EU common bonds for the first time. The issuance of these bonds will enhance the trading bloc’s financial autonomy from the US, furthering its potential role as a reserve currency.

Read MoreA V-shaped recovery is the norm, not the exception

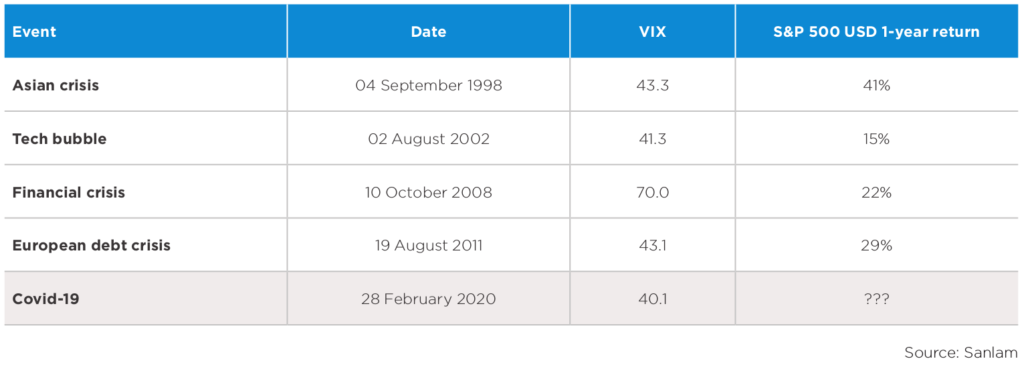

There is heightened uncertainty around the impact that Covid-19 (worsened by the recent Moody’s downgrade on SA government bonds) is currently having on markets and explains the dramatic volatility in markets in recent weeks.

Read MoreA picture is worth a thousand words

The spectacular photos that Paul Choy has captured thus far, as part of his Walk Mauritius journey, truly tell amazing tales of the beautiful contry of Mauritius and its people.

Read MoreA time for patience

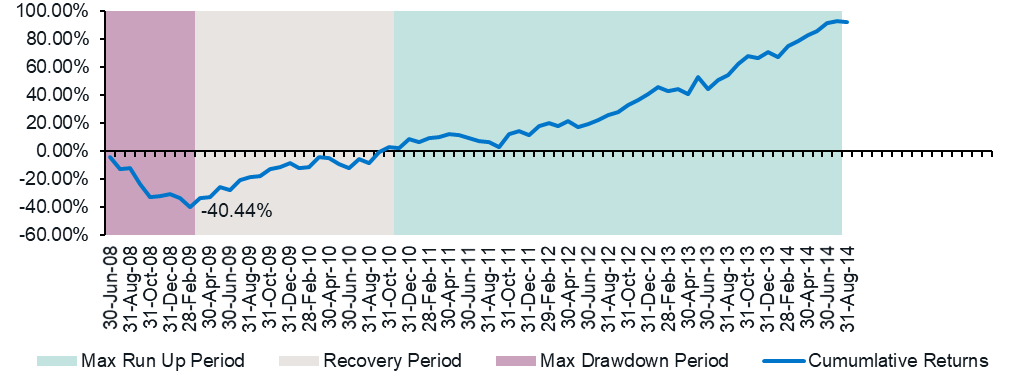

When the famous Russian author, Leo Tolstoy, wrote, ‘The two most powerful warriors are patience and time’, he could not have foreseen how perfectly it would sum

up today’s global predicament.

Can investors trust the media?

Investors are swamped with tips in newspapers, on television and online, but are media pundits worth their salt? The media has always fed off individuals’ insatiable appetite to take a punt on the stock market – offering ‘expert’ tips and forecasts in a bid to sell newspapers to investors or direct eyeballs to a television show or website. There is little doubt these forecasts are highly influential.

Read MoreThe winners and losers from Covid-19

Almost every business around the world is affected by Covid-19 in one way or another. While some have been forced to completely close, others have welcomed a tsunami of new customers that had not even heard of their product a matter of weeks before the crisis hit

Read MoreSanlam’s Pinggera: The role of a fund manager in ‘unprecedented times’

Head of multi-strategy at Sanlam Mike Pinggera speaks to Mike Sheen about how the firm’s multi-asset portfolios and Real Assets fund have held up during the ongoing coronavirus pandemic, and how our

working lives might change when the crisis subsides.

INVESTMENT STRATEGY Q1 | 2020

The question of whether the market contraction offers a great entry point into equities depends on one’s view of the economic impact that Covid-19 will have and whether any of that impact will be permanent

Read MoreEquity markets bounce back as they weigh up the future

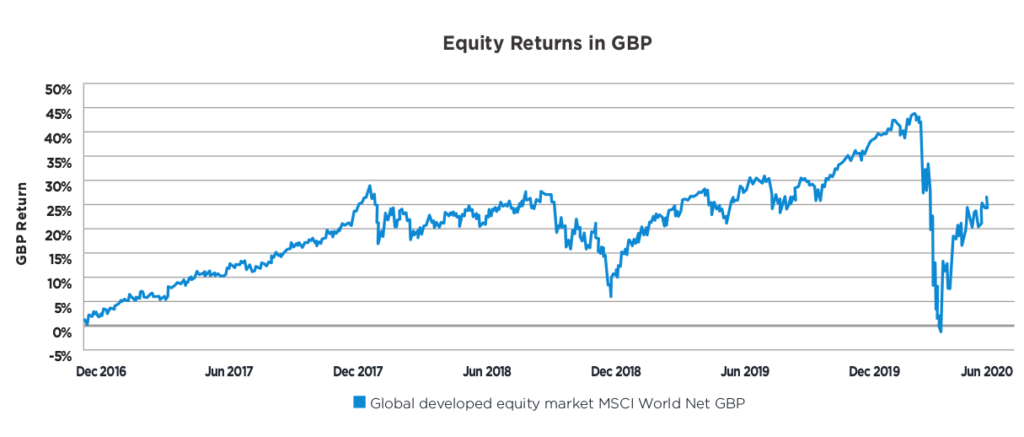

If there is one thing equity markets are good at, it’s being able to see beyond the here and now. Which explains why markets crashed well before cases of Covid-19 had peaked in Europe and the US. Investors extrapolated what could happen, but were unable to assess the impact, hence the panic and subsequent sell-off. Now markets are calmer as they look beyond the immediate impact of Covid-19 and can model the likely range of outcomes.

Read MoreCommunique from Mauritius Government on adverse listing

On May 07, 2020, the European Commission announced the adoption of a new list of third countries which, according to the Commission, had strategic deficiencies in their anti-money laundering and counter terrorism financing (AML-CFT) regimes.

Read More