A time for patience

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

A time for patience

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

When the famous Russian author, Leo Tolstoy, wrote, ‘The two most powerful warriors are patience and time’, he could not have foreseen how perfectly it would sum up today’s global predicament. Whether it’s waiting for a covid-19 vaccine, obeying ‘social distancing’ rules, or healing our broken economy, it will ultimately be patience and time that help us prevail.

The same can be said for anyone affected by the recent market crash. It’s impossible to remain invested and fully defend against a fall of that nature, and it will take time and patience for people to recoup their losses. But while equity markets appear to have stabilised for now, how do investors approach that recovery when the outlook remains opaque and markets are skittish?

Look for good entry points

The good news is that, treated with respect, volatile markets are an investor’s friend. For the last few years, equity markets have been overvalued and finding new opportunities with good longer-term returns has been difficult, to say the least. Since the crash, there is less investment risk in equity markets (if you buy low, then you don’t have as far to fall) and there are more opportunities for growth. As active investment managers, we are well positioned to take advantage of these conditions to get portfolios back on track.

Beware of survival risk

That said, there are risks at large. The next few months and years will be about ‘survival of the fittest’ and companies with high levels of debt are particularly vulnerable. As a result, we avoid investing in a company just because it is ‘cheap’. If it doesn’t survive the crisis, then hindsight will make it expensive. Instead, we remain resolute in our approach, which is to invest in resilient companies with strong balance sheets and the potential to achieve good results – even when times are tough.

Diversify

It’s also important to diversify – and not just across different asset classes, sectors and geographies. Every company we hold within our portfolios is unique and will behave differently according to prevailing market conditions. This is key when it comes to managing risk.

Be realistic and think of the long term

Until investors are convinced there are sustainable containment measures in place for covid-19, a persistent recovery in equities is unlikely. We need to be patient and allow companies to start making profits again. This won’t happen quickly, so don’t expect markets to surge in the near term. Instead, have faith in the longer-term opportunities available to us.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_image_id=”” background_color=”#0075c9″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”” box_shadow_spread=”” box_shadow_color=”” box_shadow_style=”” padding_top=”15px” padding_right=”10px” padding_bottom=”0px” padding_left=”10px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Investment view: why volatility can be our friend

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

It’s natural to fear volatile markets. Our instincts tell us that uncertainty and unpredictability are a bad thing, and the media like to prey on those insecurities with their alarmist headlines. But the truth is, calm and sanguine markets can be just as damaging if not managed correctly.

In the years leading up to the market crash in March, you could argue that a lack of volatility ultimately resulted in greater losses for some investors. Why? Because equity markets were over-optimistic and over-valued, and it became increasingly difficult to find decent investment opportunities. This period of relative calm persisted for several years and, as a result, some investors took more risk than they might otherwise have taken in the desperate search for returns. Everyone experienced losses in March, but for some those losses will have been greater and will take longer to recover from.

Over the last few years, we have been expecting a market correction and subsequent period of volatility. While we would never have wished for a market crash to break the stalemate, especially under such devastating circumstances, history has shown that when volatility is high, it can be a good time to invest.

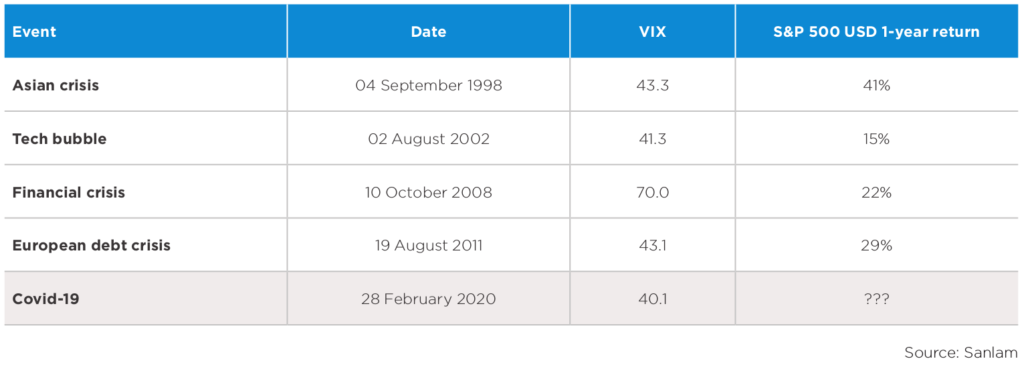

The table below shows the volatility index score (VIX) during previous crises and during the current covid-19 crisis. The VIX score is a forecast of the market’s expectation of volatility in the next 30 days. The higher the score, the more likely that volatility will occur – a score of over 40 is considered unusually high. As you can see, in the immediate aftermath of the Asian crisis, the bursting of the tech bubble, the credit crunch and the European debt crisis, markets delivered decent one-year returns.

We’re in uncharted territory right now and the current crisis may well play out differently. But what this illustrates is that markets always have their price. Amid volatility and uncertainty, investors will be searching for opportunities, which will eventually lead to recovery and growth. We don’t know when that recovery will happen, but it will. In the meantime, we are maximising the opportunity this volatility brings and are positioning client portfolios assertively for the longer term.

The information and opinion contained in this Monthly Commentary should not be treated as a forecast, research or advice to buy or sell any particular investment or to adopt any investment strategy. Any views expressed are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness by Sanlam. Any expressions of opinion are subject to change without notice.

Past performance is not a reliable indicator of future results. Investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]