Take not away the taper, leave it burning

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Take not away the taper, leave it burning

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

The Noise

- Boris Johnson has announced that he expected the final step of lifting restrictions would go ahead as planned on 19 July. This will be confirmed on 12 July after a review of the latest data. Meanwhile, yet another mutated version of the coronavirus has been identified. Experts are certainly keeping an eye on it, but they are not worried enough just yet to move it onto the “variant of concern” list that Delta and Alpha belong to.

- The Federal Reserve released the latest minutes from the Federal Open Market Committee’s June 15-16 meeting. Some members mooted that the economic recovery was proceeding faster, making the case for taking the Fed’s foot off the policy pedal. However, the prevailing mindset was that there should be no rush and markets must be well prepared for any shifts.

- Data published by the OECD has estimated the 22m fewer people are in work in advanced economies thanbefore the pandemic. The OECD also forecast that labour markets will not recover until after the end of next year and warned that rich countries could face a sustained rise in long-term unemployment.

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

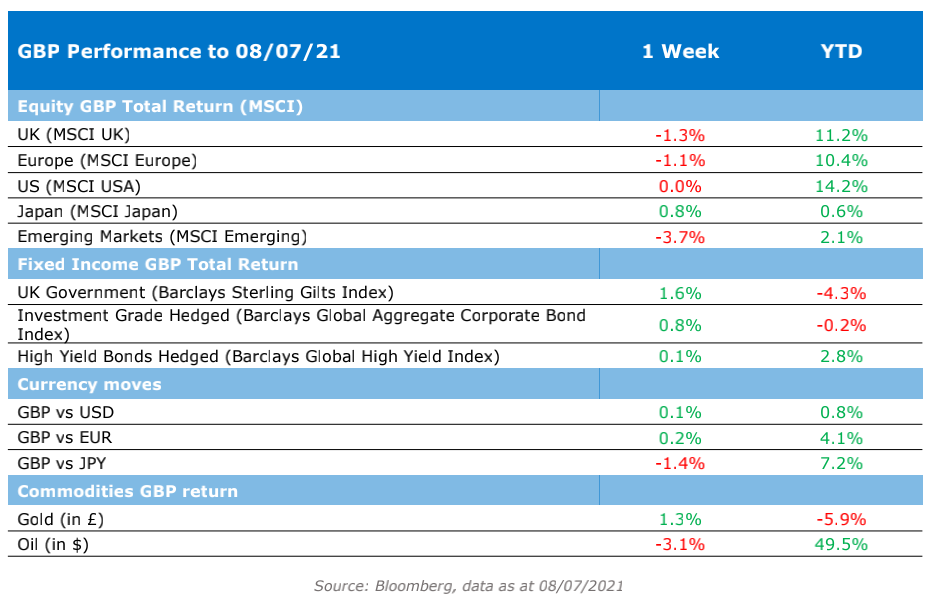

The Numbers

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

The Nuance

[/fusion_text][fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Equity markets have been soothed by recent central bankers’ dovish speeches and have largely accepted, for now, that the surging consumer price inflation is transitory. Though Jerome Powell did acknowledge to congress that 5% inflation was unacceptably high in the long term, no indication was given as to when transitory becomes persistent or even relentless. At a minimum a year would seem acceptable, and so long as the run rate is below 5% the time frame could be indefinite.

The stock market is yet to have a correction (10% fall), which is especially unusual given the considerable uncertainty stemming from the radical changes made in 2019 to the US monetary policy framework. Despite the fact that they are one of the more attractive asset classes, it would be a surprise for equities to go without a correction in the medium term. While much focus is centred on valuation, it should be remembered that over long periods of time earnings growth is the key driver of nominal returns and rising prices and the business cycle should support earnings in the medium term.

[/fusion_text][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Commentators could be forgiven for thinking that Thursday was the beginning of that correction with some significant losses being felt across the board in markets. We do expect increased volatility relative to the recent past, but this would be healthy as it keeps speculation from becoming too one sided and creates opportunities for long term investors. The primary causes seem to be worries about COVID strains, dovetailed with questions over when tapering will start. While they are both concerns, to a large degree they are not new concerns. Through this volatility, we continue to unpick the data and ensure portfolios are positioned to prosper against the underlying trends.

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_image_id=”” background_color=”#0075c9″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”” box_shadow_spread=”” box_shadow_color=”” box_shadow_style=”” padding_top=”15px” padding_right=”10px” padding_bottom=”0px” padding_left=”10px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Quote of the Week

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no” element_content=””][fusion_testimonials design=”classic” navigation=”no” speed=”” backgroundcolor=”” textcolor=”” random=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””][fusion_testimonial name=”Sky News” avatar=”male” image=”” image_id=”” image_border_radius=”” company=”” link=”” target=”_self”]

“Shortly after he sat on the toilet the Graz resident – by his own account – felt a ‘pinch’”

[/fusion_testimonial][/fusion_testimonials][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

During the pandemic, the population at large have become so much more aware of risk. What are the chances that you catch the virus, get hit by a bus or

struck by lightning? It’s all horribly morbid. But for those desperate to map out any potential danger in their life, take heed from a man in Austria who came in contact with python in the privy. So be warned the chances of encountering a python in the loo are small, but never zero.

Source: news.sky.com

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]