Sanlam’s Fourie: Why I’m happy to underperform when the market recovers

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Sanlam’s Fourie: Why I’m happy to underperform when the market recovers

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

The manager of the Sanlam Global High Quality fund said he is not willing to compromise his long-term strategy for a short-term boost.

There is a strong chance that beaten-up sectors such as energy and financials will lead the eventual recovery from the coronavirus crash, according to Sanlam’s Pieter Fourie – but the manager said this is not enough to convince him to buy into these areas of the market.

Fourie, who heads up the Sanlam Global High Quality fund, describes himself as a value investor, but one who invests in growth companies. This effectively means investing in companies with an economic moat that will allow them to win out over the long term, but not at any price.

There are numerous funds in the IA Global sector that have some sort of quality focus in their investment philosophy. However, Fourie noted that from time to time, many of these will venture into more cyclical areas such as banks, energy and automobiles – a tactic that has had disastrous consequences this year.

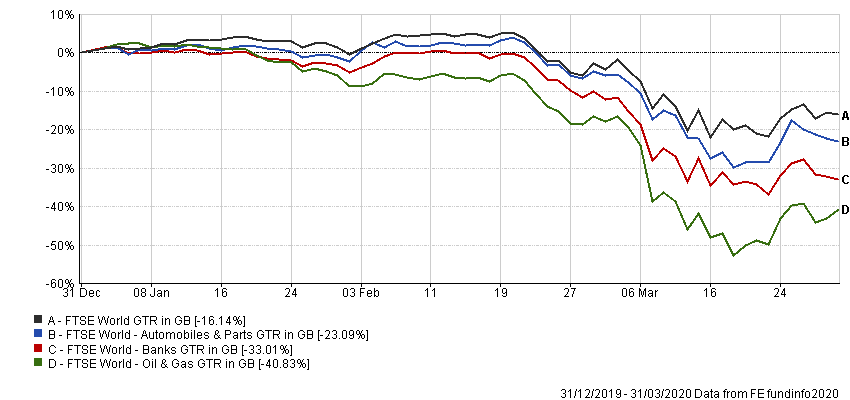

Performance of indices in 2020

“Those strategies have failed miserably, because what was attractive before is now even more attractive,” he said.

“So the spring or the elastic band has been stretched once again: growth stocks have outperformed value.”

The flipside to the sell-off in value stocks is that these have become even cheaper than they were before, and as a result, there is a strong chance they will rebound the hardest when the coronavirus crisis is over.

However, Fourie said that in 20 years of running money he has learned the hard way it is better to focus on what he can control rather than what he can’t – which means focusing on fundamentals and businesses that can help themselves, rather than making a call on the economic recovery.

“We know that on face value, Lloyds and BNP Paribas look cheap, but they have been cheap for a while and the risk to their business model has now been brutally exposed,” the manager continued.

“I appreciate everything I read about buffers and tier-one capital which suggests they are in a much better place than they were in the financial crisis. But my question is, in what way will these businesses add value as measured by return on equity?

“Nothing has changed for me. If there’s a snapback like we saw in August to the end of November, we are going to underperform.

“That doesn’t mean that we are going to say to ourselves, ‘you know what, we don’t have exposure to 30 per cent of the market in the form of financials, industrials and energy. We’re got to close that gap.’”

Another reason why Fourie is unconvinced by the deep-value trade relates to the asymmetric return profile of this strategy in the current environment. For example, he said that in obscure parts of the energy sector such as oil services, a couple of companies are likely to quickly become “10 baggers” when the market recovers – but only because most of the competition will be wiped out.

“The seeds are being sown for a couple of survivors,” he explained. “But along the way, you’re going to have so many accidents and that’s what has happened to deep value.

“How do you recover from that massive underperformance to eventually pick the winner?

“Our strategy has shown that in the long term, if we make sure we buy businesses of much better quality, ultimately that is going to beat the strategy of buying cheap out-of-favour names on the assumption that the market will at some stage get interested and you can therefore time your entry point and exit point.”

Fourie said that if he were to sum up his strategy in a single line, it would be to think like the owner of a business. He pointed to Bernard Arnault, chief executive of LVMH as a good example – the manager noted that even though he is worth about €50bn, he is always thinking about how he can enhance his business, primarily through acquisitions.

“Even though that business has been expensive for a while, that is the sort of name that we would be interested in if we could see normalised earnings,” Fourie continued.

“It is still quite elevated, but it’s a good example of a business which in the very long term has great secular tailwinds behind it and offers significantly higher return on equity than the market.

“Since the end of 1998, post the Asian crisis, it made 17x your money of which 500 per cent came from the reinvestment of dividends. The market made about 130 per cent.

Performance of LVMH since 1990 (price only)

“With the exception of the financial crisis, that stock never really got cheap throughout that journey.

“No decent value stock is going to give you those sorts of outsized returns unless you are buying distressed positions. That strategy is probably going to work in this environment because there are so many washed up names. But it’s not a successful strategy in the long term.”

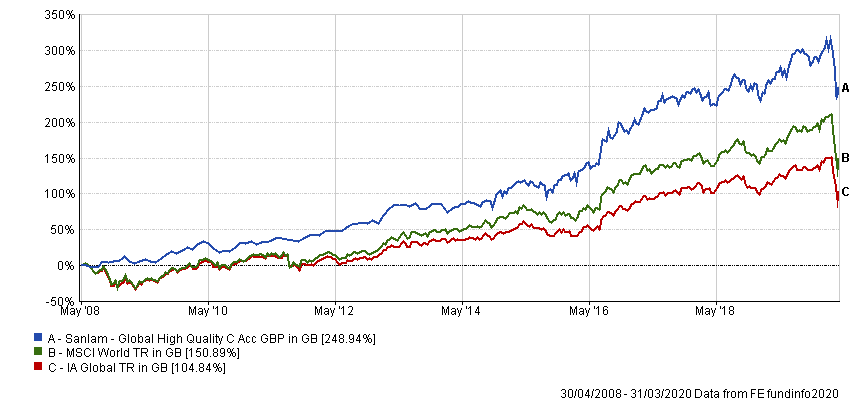

Data from FE Analytics shows Sanlam Global High Quality has made 248.94 per cent since launch in April 2008, compared with gains of 150.89 per cent from the MSCI World index and 104.84 per cent from the IA Global sector.

Performance of fund vs sector and index since launch

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]