Investors seduced by equity returns

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Investors seduced by equity returns

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

This time last year it was hard to escape the prospect of a global recession. Twelve months later and we are looking forward to a recovery in global economic growth, thanks to progress in finding a US-China trade compromise, and the likelihood that President Trump will be economically supportive leading up to the presidential election in November.

Another reason for this turnaround is that central banks were quick to reverse interest rate hikes last year when they realised this approach was destabilising the global economy. Now they seem committed to keeping interest rates low, and we expect to see moderate economic growth this year as a result. This will sustain high levels of employment while giving more spending power to the consumer.

The trouble with fixed income

This is positive news for business and the economy, but it comes at a price. There is now very little value to be found in bond yields, and the risks associated with investing in fixed income assets are higher than normal. Should inflation increase, for example, bond returns could head into negative territory this year.

Flight to equities

In contrast, equities offer the opportunity to grow earnings, and therefore returns – especially with a backdrop of supportive government and monetary policy. As a result, there has been a flight to equities as investors accept they must take more risk if they want to achieve some return. Inevitably this has become a double-edged sword. Returns last year were very good, but equities are now looking over valued and new opportunities are hard to find. At the same time, seemingly successful businesses are borrowing heavily to drive impressive growth and are at great risk should the cost of that borrowing increase – an issue that surfaced when US interest rates were increased in 2018.

What does this mean for investors?

Our key concerns are unchanged – the shorter-term risk of recession and the longer-term risk of inflation. We remain focused on good quality companies that have a strong balance sheet, and that are positioned to deliver in both a slower growth economy and a higher-inflation environment over the longer term. Recently, we’ve seen companies that have delivered results be rewarded by investors, meaning their share price increased as others fell. As a result, we’re confident that we have the right investment strategy amid ongoing economic uncertainty. Pressure is building on central banks to lower interest rates and help the global economy stave off the threat of recession. The European Central Bank (ECB) failed to deliver a rate cut in July, but the US Federal Reserve (Fed), after much talk, finally ‘walked the walk’ on the last day of the month and reduced interest rates for the first time since 2008.

The Sanlam view

We think the answer is to stay invested in solid and established companies that are well positioned for an economic downturn and an inflation shock in equal measures. At the same time, we look for hidden opportunities, where good companies have been unfairly undervalued. They’re harder to find at times like these, but with detailed research and analysis, such opportunities do exist. At the same time, we remain diversified across different asset classes and geographies, helping us to manage risk on behalf of clients.

“After a rewarding 2019, the economic outlook is positive for the year ahead. Although equities are expensive, we won’t shy away from equity markets but will focus on investing in good companies with strong balance sheets and finding pockets of value where we can.” – Philip Smeaton, Chief Investment Officer

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_image_id=”” background_color=”#0075c9″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”” box_shadow_spread=”” box_shadow_color=”” box_shadow_style=”” padding_top=”15px” padding_right=”10px” padding_bottom=”0px” padding_left=”10px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Investment view: Why technology is enhancing the property opportunity

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

It seems ironic that technology and a move to transacting online should give rise to property investment opportunities. Most people consider the growth of online shopping to have been a blow for the property sector, and investors in the high street may well agree. But several niche opportunities have emerged over recent years, proving markets adapt to consumer needs and investment opportunities exist for those who spend time searching for them.

[/fusion_text][fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Warehouse/ Distribution Centres

The burgeoning demand for online shopping and fast home delivery has meant that large warehouse and distribution centres are essential in today’s retail strategy. The need for these warehouses is growing, and good facilities in good locations (near major road networks and within striking distance of large populations) offer investors the security of long leases and the potential for positive rental growth. Such properties have benefited at the expense of retail outlets, albeit are now highly valued which reduces potential returns.

[/fusion_text][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Data centres

When we talk about ‘the cloud’, our data isn’t stored somewhere ‘up there’. Of course not. Instead, it’s stored in one of the many data centres being built around the world. With the need for digital storage growing so quickly, these data centres make a good investment from a supply and demand perspective. It’s not easy to move large data centres which are best located close to major internet nodes, so leases tend to be long and offer good, reliable returns.

[/fusion_text][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Other specialist Real Estate Investment Trusts (REITS)

There are several ways to invest in the property market without having to buy ‘bricks and mortar’. One of our favoured approaches is investing in REITs. This means investing in a company that buys and manages several properties on behalf of its shareholders. The value of the company (and therefore its shares) reflects what investors are prepared to pay for a share in the company, rather than what the company believes its properties are worth. Over recent years the choice for property investors has significantly increased, and companies can specialise in areas where they have a competitive advantage.

[/fusion_text][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no” element_content=””][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

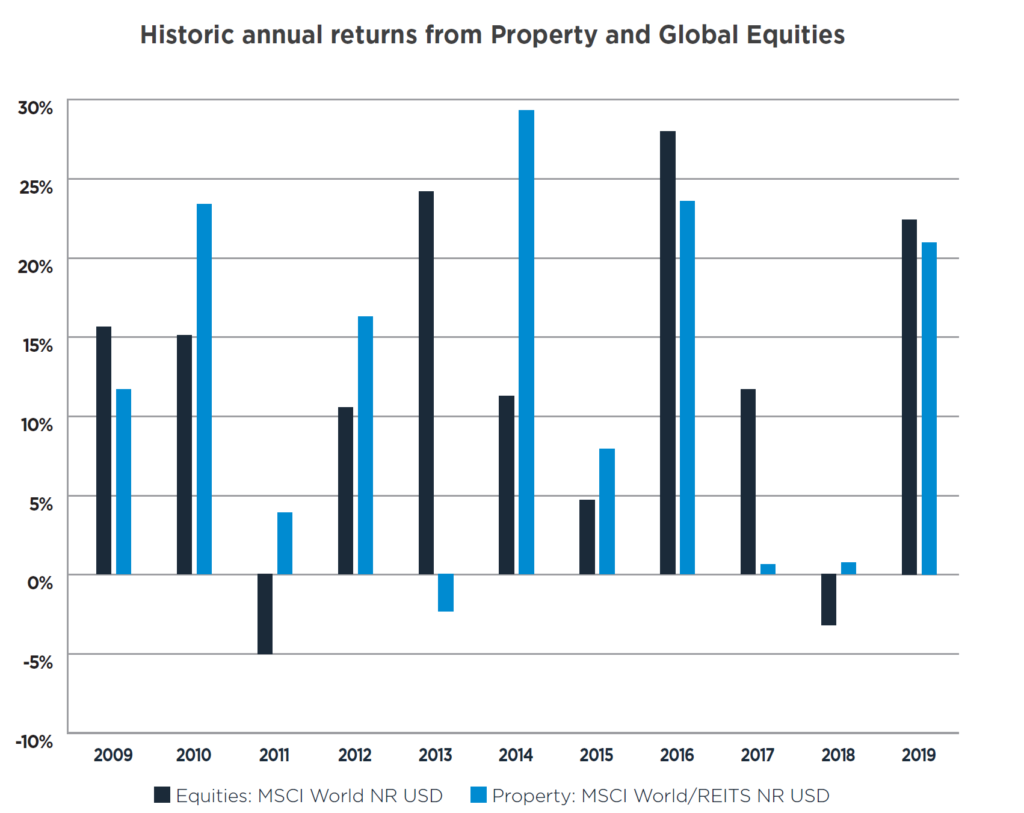

Comparing Property and Equities

As you can see from the graph, property and equities sit well together in a diversified portfolio, as they tend to behave differently according to prevailing market conditions.

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Source: Sanlam Private Investments (UK) Ltd

Download: Market Outlook – February 2020.pdf

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]