GLOBAL MARKETS: HOW NERVOUS SHOULD INVESTORS BE?

In the current murky investment environment, it is an understatement of note to suggest that financial markets are jittery and have in many sectors been pushed into bear territory. Given the material sell-off in both equities and bonds, just how nervous should investors be? And how should one approach portfolio construction in these circumstances?

Since the S&P 500 high recorded in November, shares in the US have fallen by 24% at the time of writing – just more than the 20% generally viewed as indicating a bear market. The technology-dominated Nasdaq index has now lost more than 38% and is clearly in bear market territory. And it’s not only equities that have given up much of their gains. Since November last year, long-dated US government bonds – often seen as a safe haven when equities are selling off – have lost an astounding 21%.

Since these two asset classes normally constitute the major building blocks of a multi-asset portfolio, it raises the question of how asset managers should construct a balanced portfolio for individuals when its two key pillars are under severe attack.

A good starting point would be to look at the developments preceding the major decline in these asset classes. Following the pandemic lockdowns and the sell-off in equities in the first quarter of 2020, economic authorities responded to the second-quarter recession by opening the taps – they provided unprecedented stimulus, creating money by buying government bonds, slashing interest rates and expanding fiscal policy by paying social grants to consumers qualifying as ‘victims’ of the economic fallout.

To be fair, these measures achieved their initial economic objectives. The global economy recovered and job losses were largely reversed to the point that the unemployment rate in the US is now the lowest since the Second World War.

DEMAND FOR ‘SEXY’ ASSETS

Unfortunately, from a financial market perspective, the stimulus created an enormous amount of liquidity looking for an investment ‘home’, which drove the price of money down to unsustainably low levels. With interest rates at virtually 0% and excess money in the hands of unsophisticated investors, one can clearly understand the zeal to buy assets with a great story in this so-called ‘new normal’ environment.

Of course, this frenzy drove prices higher, seemingly vindicating the decisions of these traders. The demand for a range of ‘sexy’ financial assets unfortunately drove the prices of these assets to levels that in our view were discounting only good news and were failing to factor in that even in the case of growth shares, one should consider that the cycle may well peak and cool off.

Put in simple English, we’ve generally argued since the second half of 2021 that these assets were too expensive, or that prices were simply too high. In fact, we’ve stated since the latter part of 2020 that we don’t understand how investors can buy a government bond in Europe that will yield a negative return if one holds it to maturity. We also don’t understand the price movements of cryptocurrencies and have therefore never included them in any of our portfolios.

In the real world, the unprecedented stimulus created increased demand for goods, and the supply-side bottlenecks caused inflationary pressures over a wide front. Initially, it was thought that these pressures would be merely transitory or temporary, but they’ve turned out to be far stickier than the initial estimates of central bankers and the models of most economists.

INFLATION CONCERNS GROW

It was at the US Federal Reserve’s December meeting that the investment community finally realised that monetary authorities would have no choice but to address the inflation problem and would hike interest rates to levels higher than initially expected. This would have the effect of, first, revising economic growth forecasts downwards, and second, reducing liquidity and increasing the price of money – a sequence of events likely to reverse the upward spiral set out above.

Higher interest rates and the prospects of a sustained higher rate cycle to bring inflation back to the 2% target range – in the US – also mean that when investment analysts value a company, they are likely to use a higher discount rate to calculate its intrinsic value, which inevitably translates to a lower value for the company. In addition, lower economic growth forecasts reduce the earnings expectations for companies in general. It is this financial recalibration that should lead to lower equity prices.

I’m not convinced that unsophisticated retail investors would look at equities the same way. However, if these investors had bought such assets because they had surplus cash, and the prices of these assets appreciated handsomely, it would not be unrealistic to expect them to sell these assets because prices are falling and liquidity is no longer freely available.

HOW TO POSITION PORTFOLIOS

But enough history and theory – on a practical note, what should investors do now, given the material and ongoing sell-off in equities and bonds? How nervous should investors be? And how should one approach portfolio construction in the current murky global environment? It’s important to answer this question from the point of view of the current positioning of our multi-asset portfolios:

- We reduced our global equity exposure during 2021 and in April this year. Within equities, we have a low exposure to growth shares, generally owning shares with a predictable earnings stream. In South Africa, a third of our equity shares are invested in mining and, as in the case of our offshore equities, we have a material exposure to shares with a predictable income stream.

- The portfolios have a low exposure to international sovereign bonds, but we do hold a material exposure to South African government bonds, as these yields are attractive.

- We own alternative assets designed to produce returns with a low correlation to equity price movements.

- Property exposure to local and offshore assets has been reduced.

- Gold – not gold shares – was added to our multi-asset portfolios.

Given the clouded macro-outlook and the material change in investor sentiment, it is tempting to go with the flow and reduce equities further. As always, however, our starting point for portfolio action is price. South African equities don’t look expensive, provided that commodity prices don’t collapse against the background of slower economic growth. The rest of the market offers decent value. Rather than managing equity exposure, we believe it is now more important to get the selection right within this asset class.

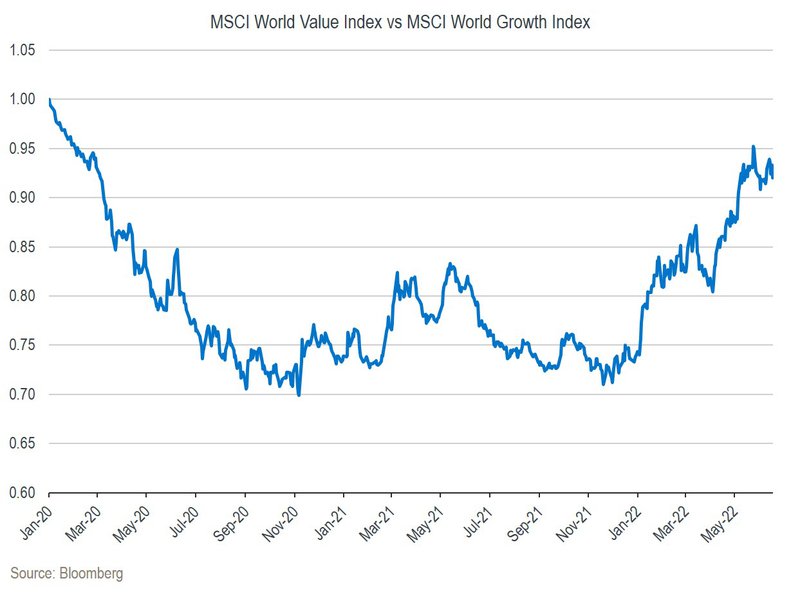

The same applies to offshore equities. Our positioning in this asset class is defensive – we predominantly own shares in companies with a boring, but predictable income stream. For now, we don’t foresee any changes to this approach. The chart below shows how, from January 2020 to November 2021, value shares – which we favour – underperformed their growth peers. However, the tide has turned, and we’re now reaping the benefits of our patience with this strategy. We believe the trend is likely to continue as the value is only now starting to emerge in the growth universe.

Given our already reduced equity exposure in these portfolios and the defensive nature of these equities, we’re unlikely to meaningfully reduce the combined exposure of local and global equities.

The motivation to include government bonds in our multi-asset portfolios is twofold. First, there are times when the income yield is attractive. Second, they provide an uncorrelated return to equities, particularly when equities sell off. In the case of global bonds, however, the yields are simply too low, for the reasons mentioned above. They have therefore not demonstrated uncorrelated price behaviour. Should yields continue to move higher, we’re likely to reconsider our decision not to invest in this asset class.

We’ve reduced property exposure across the portfolios. Despite a material sell-off in these assets, in our view, the cycle remains under pressure, and it would be premature to attempt to bottom-fish in this area. Property generally has a tendency to perform relatively poorly in a rising interest rate environment, and it’s unlikely to be different this time.

The exposure to alternative assets was increased in recent months. However, we need to be very clear on the strategy here. It is a defensive one – the intent is to reduce the volatility of the overall investment performance. The inclusion of alternative assets is not designed to provide equity-like returns, but to protect the portfolios during an equity sell-off and to beat cash after costs – our exposure to the Janus Henderson Global Multi-Strategy Fund since November last year has done exactly this.

Lastly, we’ve added a small proportion of direct gold exposure for select client portfolios. In South Africa, whether or not to own gold is always a heated discussion. Traditionally, gold performs well in times of uncertainty, as it did in the 1970s when inflation spiralled out of control. We’re not suggesting that we’re about to relive a spiral of that magnitude, but the risk of higher-than-expected inflation remains elevated. We therefore view our exposure to gold as an ‘insurance policy’ in our portfolios.

IN A NUTSHELL

The sell-off in global equities and bonds has justifiably scared many investors. The high prices in certain sectors and geographies have concerned us since mid-2021 – despite the continued strong performance of equities until late last year. We trimmed our equity exposure in our multi-asset portfolios during the bull run of 2021, and again in April when we couldn’t ignore the ominous inflation signs and their policy implications.

Within equities, we remain conservatively positioned, and we have limited exposure to bonds. In our view, this is the correct position for portfolios focused on the long term – and it provides optionality to buy good assets should the negative sentiment in financial markets continue for the foreseeable future.