Economic output has recovered, but should we fear a financial reckoning?

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Economic output has recovered, but should we fear a financial reckoning?

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

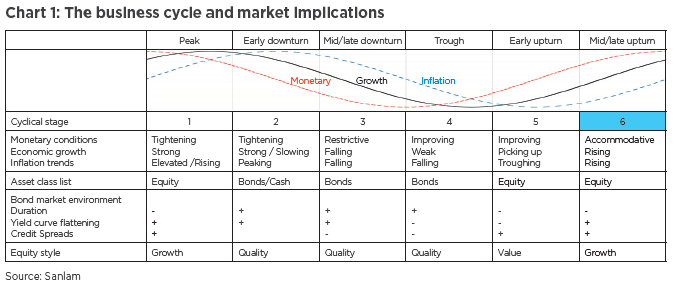

From the rapid nosedive following lockdowns in March 2020 to springing earnings in the first half of ‘21, we’ve moved through this business cycle at top speed. It’s time to take a look at potential market implications and ask ourselves: does economic payback await?

While we’ve all enjoyed some return to normality as vaccination rates increase and shops and pubs repopulate, investors are starting to question the growth narrative: can we continue to expand from here? Is an end to quantitative easing around the corner? And paramount to that: where exactly are we in the business cycle?

The chart below gives an overview of the phases of a general cycle. You can see clearly what we experienced last year—the trough of early 2020—and also the upturn we began to enjoy as vaccines were disseminated and workers returned to the services and manufacturing industries. We’ve steamed through the cycle at a very rapid pace, and the question we’re now asking is: how soon will we step out of box 6 and move into the peak of the cycle?

The recession wrought by Covid was unique. There was a sudden drop in GDP (the result of shutting down the economy overnight) followed by an almost immediate recovery back to levels seen pre-pandemic. The most stunning aspect of this bounce-back is how quickly it happened—a consequence of unprecedented monetary stimulus and fiscal support. Interest rates languished at zero; central banks bought corporate debt as well as sovereign. Bankruptcies were avoided by the protection of stimulus, and barely a year had passed.

And now the question is, of course: will there be retribution for eliminating the stresses that otherwise would have pressured the system? Probably. And the way that payback is likely to manifest is in the form of inflation. Now the journey becomes more arduous. Growth rates will slow while inflationary pressures rise. Corporate news flow is littered with companies intending to pass cost pressures on to their customers. Will the Fed begin to taper, an indication that we’re moving into box 1 of the business cycle, which starts to get a bit riskier?

We’re not there yet. From an investment perspective, we still favour equities. Just remember the pace at which this cycle proceeded and be ready when defensive positioning is needed.

[/fusion_text][fusion_testimonials design=”classic” navigation=”no” speed=”” backgroundcolor=”” textcolor=”” random=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””][fusion_testimonial name=”Philip Smeaton, Chief Investment Officer” avatar=”image” image=”https://sanlamprivatewealth.mu/wp-content/uploads/2020/09/Philip_smeaton.jpg” image_id=”2647|full” image_border_radius=”” company=”” link=”” target=”_self”]

“People have been talking about inflation for a long, long time (since the Great Financial Crisis), but it’s never really materialised—until now.”

[/fusion_testimonial][/fusion_testimonials][fusion_separator style_type=”none” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” sep_color=”” top_margin=”10″ bottom_margin=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” /][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_image_id=”” background_color=”#0075c9″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”” box_shadow_spread=”” box_shadow_color=”” box_shadow_style=”” padding_top=”15px” padding_right=”10px” padding_bottom=”0px” padding_left=”10px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Investment view: Are China’s stricter regulations as worrisome as they seem?

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

As The New York Times touted just last month, “A portfolio in 2021 isn’t global without China.” But neither, it seems, is a financial news report. With fresh crackdowns on numerous sectors (tech, education) being introduced almost by the day, investors would be forgiven for eschewing the once-sleeping giant.

[/fusion_text][fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

But as always, it’s important to view this with a wide lens and play the long game. The recent regulations imposed on some of China’s major industries aren’t so much about business as they are about government, or more accurately, governing. Case in point: it was announced on 25 August that ‘Xi Jinping Thought’ (apparently similar to Marxism) will henceforth be included in the national curriculum for all Chinese students from children to college kids.

The story in China is very much about the man behind the mandates, and analysing the mind of a man to determine his actions is hardly a scientific endeavour. Yes, President Xi wants a stronger grip on power for his party. But let’s take a look at the facts.

In November 2020, the State Administration of Market Regulation (SAMR) officially introduced new rules with which it would regulate Chinese tech companies. The SAMR headed straight for the top, fining tech giant Alibaba a record US$2.8 billion in April as a result of an antitrust probe and quickly calling up 34 other major tech and media companies (among them Tencent, Baidu and Meituan) on accusations of misleading the public and ‘merger irregularities’. A handful of ride-hailing apps were suspended for inadequate data security.

Here’s an interesting way to look at it: a number of outlets, including the Washington Post, have professed that China is just doing what that other producer of tech titans, the United States, wants to do but just can’t seem to: effectively regulating one of its richest industries. Could the Chinese crackdown be akin to the implementation of ESG initiatives? After all, crafting a portfolio with sustainability in mind is a desirable way to invest these days, and, as evidenced by the chart below, the Shanghai Composite actually rose in August.

[/fusion_text][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

But of course, this is a picture of moving parts, and as such, investors should proceed with caution. The 21st century has seen Napoleon’s giant awake: China has incubated many successful companies in the age of the internet, which is why the Communist Party now seeks to regulate them. An increase in regulatory risk is certainly something investors should both control and look to be compensated for.

A wise investor might limit the capital he or she deploys into the region, but as ever, it is important to stay objective when considering risk. These businesses are a victim of their own success—despite the increased risk, they are infused with the Chinese entrepreneurial spirit and remain a key ingredient in the recipe for future growth.

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]