Coronavirus special: counting the cost and looking ahead

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Coronavirus special: counting the cost and looking ahead

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

As far as equity markets are concerned, the development of the coronavirus crisis has been as rapid as it has been unprecedented. As the epicentre of the virus moved from China to Europe, there was a sudden realisation that we were in the grip of a global economic shutdown, and equity markets repriced quicker than we have ever seen before. This month we discuss why markets reacted so aggressively, and what we can expect in the weeks, months and years ahead.

Three things to remember in these difficult times

We have tried to keep this update as succinct and reassuring as possible, but there are three key points we would like you to take away:

- Trust in your investment plan, which was developed in less volatile times. Let us focus on getting your investments back on track, while you look after your health and your loved ones.

- Markets may fall further, but they will recover. We will benefit from that by making well-researched, data-driven buying decisions.

- Look forward, not backwards. We can’t change the past, but we can make the best possible decisions for the future.

Why did markets react so aggressively?

Equity markets remained surprisingly unphased in the early stages of the coronavirus crisis, despite China placing itself in lockdown and supply chains coming to an abrupt halt. But when the epicentre of the virus moved to Europe, the landscape changed, and this was quickly exacerbated by news that Saudi Arabia had instigated an oil price war. Normally we talk about concerns of an economic slowdown, but suddenly we were talking about a global economic shutdown – something none of us have experienced in our lifetime.

The resulting market crash was ultimately driven by concerns over the level of debt companies have and whether they can survive this. Thanks to government bailouts, it may be some time before we know the true cost to business and the overall economy, and we can expect continued volatility for the foreseeable future as a result.

Are we over the worst?

Predicting when markets will hit the bottom is impossible, but we believe they will start to turn the corner when there is:

- evidence we are containing the spread of the virus

- an idea of the duration of the economic shutdown, and signs that people are returning to work

- widespread testing

- the promise of a vaccine

There is already positive news coming out of China, as the country appears to be putting the worst of this outbreak behind it. But with the US yet to peak, we can’t predict what will happen next, and our focus is on protecting client portfolios from future falls, while taking advantage of good short-term buying opportunities

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_image_id=”” background_color=”#0075c9″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”” box_shadow_spread=”” box_shadow_color=”” box_shadow_style=”” padding_top=”15px” padding_right=”10px” padding_bottom=”0px” padding_left=”10px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

Looking ahead

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””]

We have talked for some time about the fact that equities have been expensive, which meant new opportunities were hard to find. While markets may yet fall further, we can start to take advantage of some of those buying opportunities.

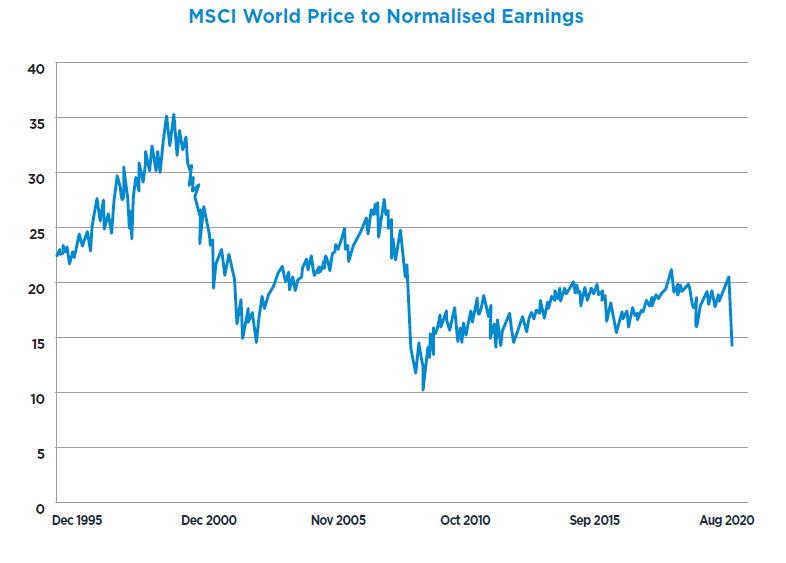

Company earnings can be volatile from year to year, but by smoothing out this ‘noise’ we can determine the earnings power of a basket of global equities. Comparing current share prices to this earnings power gives a sense of how cheap, and thus attractive, equities are. As the chart shows, on this measure current market prices are giving investors one of the most attractive entry points since 2009.

A bad time to panic, a good time to invest

Our focus will be on finding resilient companies with low levels of debt and less reliance on achieving good sales. These businesses stand the best chance of getting through this and providing us with good long-term returns. We will also hold some cash to enable us to lock in opportunities as soon as the markets start to recover, and we have sight of the light at the end of the coronavirus tunnel.

At the same time, we must be mindful of the risk of inflation. Historically, inflation has occurred when governments spend more than they are taking in taxes, and when this is supported by monetary policy – both of which are happening globally as a result of this crisis. There will be longer-term repercussions of the unprecedented levels of fiscal help we are seeing, and this could be in the form of inflation. As a result, we remain invested in inflation-linked government bonds, gold, and companies that can maintain their bottom line in a higher inflation environment.

Conclusion

There’s no question that the last few weeks have been some of the worst in the history of equity markets, and almost everyone will feel the effects of this crash in one way or another. But temporary losses are part of investing, and the best thing you can do at this juncture is to avoid making rash decisions in the coming weeks.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]