Monetary policy couldn’t get easier; there’s only one place to go from here

[fusion_builder_container hundred_percent=”yes” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”0px” padding_bottom=”” padding_left=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”yes” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”” border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Monetary policy couldn’t get easier; there’s only one place to go from here

[/fusion_text][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Fiscal conditions are incredibly accommodative: interest rates are lying low; credit is freely available; and GDP is as if Covid never happened. The time to taper is nigh.

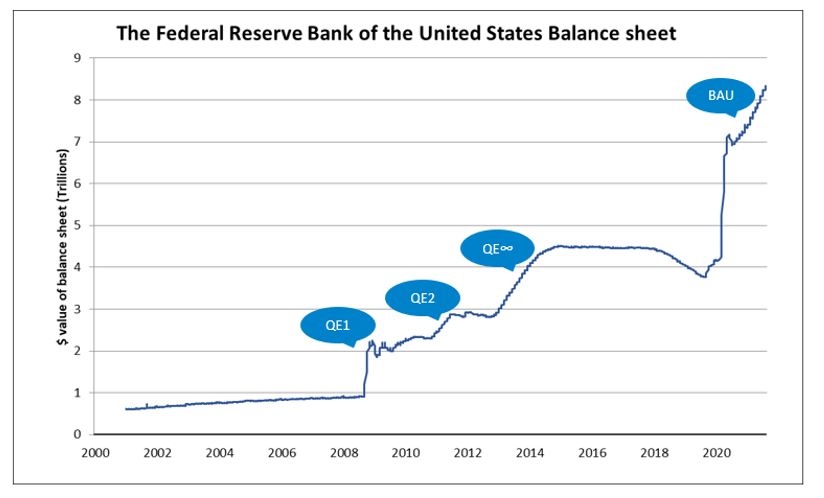

First, a quick history lesson: 2008 brought the Great Financial Crisis, and with it, the introduction of a practice called ‘quantitative easing’ (QE). This involved the US Federal Reserve announcing that it would purchase a defined amount of government bonds circulating in the marketplace. In order to make those purchases, it would print new cash. The theory was that injecting new money into the economy was going to stabilise the banking system by allowing banks to have more cash on their balance sheets while simultaneously lifting the market—and imbuing the public with the confidence to spend.

It was designed to be temporary. But every time the end date to the programme approached, people would get nervous and pull their money from the market, defeating the purpose of the Fed feeding in funds. And so QE continued in perpetuity.

You can see from the chart above the bounce that the Covid crisis necessitated. But before that, in 2018, the line starts to dip: this is where the mythical ‘taper’ was attempted—and for a moment in time, sustained—and is a crossroads at which we find ourselves again. The Fed is not going to pull the plug on its bond-buying scheme and, in all likelihood, it’s not going to raise interest rates for at least a few more quarters.

Before those things come to pass, it is going to taper the volume of its purchases: instead of buying $110bn in bonds every month, the bank will decrease the amount to $100bn, and then $90bn, and so on in a very gradual process. It’s important to remember that key to the practice of tapering is the pace at which it is likely to occur.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_image_id=”” background_color=”#0075c9″ background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius_top_left=”” border_radius_top_right=”” border_radius_bottom_left=”” border_radius_bottom_right=”” box_shadow=”no” box_shadow_vertical=”” box_shadow_horizontal=”” box_shadow_blur=”” box_shadow_spread=”” box_shadow_color=”” box_shadow_style=”” padding_top=”15px” padding_right=”10px” padding_bottom=”0px” padding_left=”10px” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Investment view: Tapering in ‘21

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_image_id=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

The tide is starting to turn. Year 2 of Covid has been coloured by buoyant stock markets and ascendant inflation, and the temptation to taper is creeping in.

[/fusion_text][fusion_builder_row_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

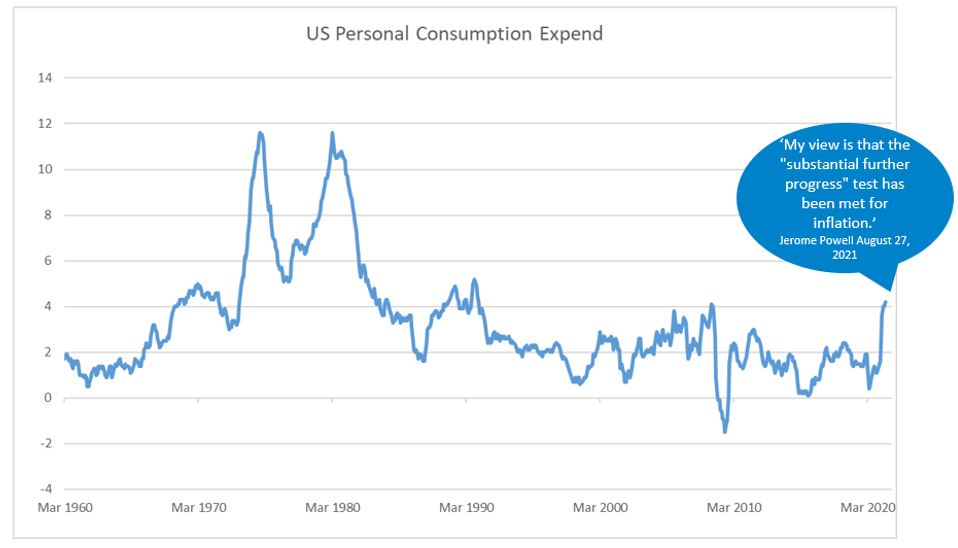

The bull market persists. Unemployment in the US has dropped almost 10 percentage points over the last 12 months. And inflation, whether transitory or lasting (the jury’s still out), is high. August’s Jackson Hole Symposium, a virtual meeting of the Federal Reserve, left little room for interpretation. As you can see from the chart below, Fed Chair Jerome Powell said in no uncertain terms that he believes inflation to be at a satisfactory enough level to consider the economy in rude health, and noted that ‘there has also been clear progress towards maximum employment.’

This can be taken as a strong indication that the Fed is going to curb its buying, perhaps before the year ends.

But, to do our part to prevent a ‘taper tantrum’ (skittish investors pulling their money from the market), let’s take a moment to explain two things: first, why the focus on the Fed? The Bank of England and the European Central Bank have been equally active in injecting federal funds into their respective economies. The US comprises about 60% of global markets. Furthermore, the US dollar is the currency used in most global transactions. For example, oil is generally sold in dollars. Therefore, price movements of the dollar are systemic events that move through everything.

[/fusion_text][/fusion_builder_column_inner][fusion_builder_column_inner type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” hover_type=”none” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” border_radius=”” box_shadow=”no” dimension_box_shadow=”” box_shadow_blur=”0″ box_shadow_spread=”0″ box_shadow_color=”” box_shadow_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Secondly, and most critically, the tapering of asset purchases and the raising of US interest rates will be separate and distinct events. Tapering, a much gentler version of monetary tightening, will occur first. Central bankers are becoming marginally more hawkish—50% of the Federal Open Market Committee said in September that they feel interest rate rises will be appropriate in 2022—but at the heart of every move will be an effort to preserve the impressive late-Covid recovery. Hence, the rather safe assumption that the tapering of asset purchases will precede interest rate rises by a fair few months.

The rate of growth has slowed, and much of this has to do with inflation. Inflation doesn’t hit everyone at once; it moves through the economy in waves. It represents a constant process of extra demand. We’ve seen this happen in the consumer staples sector. The cost of food increased. From there, the cost of product packaging rose. In turn, shipping prices went up. Companies don’t want to increase prices, lest it disturb demand, but if higher inflation settles in, they have to pass those additional costs on in order to maintain profits.

We’re going to see different companies be influenced by inflation at different points in time. As investors, it’s key for us to monitor this and understand that elevated valuations reduce the margin of safety. We’ll need real conviction in the companies we keep as policy tightens and tapering takes hold.

[/fusion_text][/fusion_builder_column_inner][/fusion_builder_row_inner][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container admin_label=”” hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”0″ margin_bottom=”0″ padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” hover_type=”none” link=”” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” undefined=”” background_repeat=”no-repeat” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”0″ padding_right=”0″ padding_bottom=”0″ padding_left=”0″ margin_top=”0″ margin_bottom=”0″ animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_modal name=”ethics_hotline” title=”Fraud and Ethics Hotline” size=”small” background=”” border_color=”” show_footer=”yes” class=”” id=””]

If you require assistance on any ethical and/or fraud issue which may have arisen pursuant to your interaction with Sanlam Private Wealth Mauritius Ltd, please contact the Sanlam Fraud and Ethics Hotline at +27 12 543 5324 which hotline is operated by an independent third party and guarantees anonymity. If you are unable to call the hotline you may send an e-mail to sanlamfraud@kpmg.co.za or submit a report online at www.thornhill.co.za.

[/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]